Affiliate Landlord: Hitting the Streets – Tour #2

December 22, 2014 Posted by Tyler Cruz11 days ago I published a post on my walkthrough tour of some rental properties I was interested in purchasing.

A couple days ago I went out for a 2nd tour, this time for new properties I was interested in, and so I thought I’d share how it went again.

As with the first time, I had an absolute blast again. It’s just so fun to go out and look at something physical to invest in. I’ve been working online nearly my entire working life and so the closest to any “asset” I’ve ever had was owning income-generating websites – but again that is still entirely digital.

Anyhow, let’s proceed with the 2nd tour! This time, we left a little bit earlier and set out to look at 5 properties. Inventory here right now, partly due to the season, is really low and there actually aren’t too many other rental properties available.

Property #5: The Ocean View Duplex

Funnily enough, this is another property on the same street as my favourite property from my first viewing. It’s one of the streets in my town that is infamous for being fairly undesirable to live in.

However, the street is pretty long and this property was situated at the very other end of the worst part of it. Basically, it’s the “rich” end of the street. I didn’t even know the street went that far or that the property value increased as you head along it.

The property is a Duplex priced in the low $400K’s and has only been on the market for 2 weeks.

What amazed me first and foremost was the view. While not perfect (there’s some logs floating around from the logging industry here, and partially blocked with a few trees), the property is quite high up that you still get quite the view. It’s December and was raining when we went, and yet I’d still classify it as a “million dollar view”.

In fact, the view is taken advantage of with the layout of the construction. For example, the kitchen window overlooks it, as does the living room windows. It’s just a bit amazing to have such a view at this price range here.

Below is an actual shot courtesy of Google Street View of the view… but that’s taken at street level – again the property is quite high up so it really gets a much better view. You’ll just have to trust me that the view is a lot better than this photo ![]()

Setting the view aside though, this duplex was just simply awesome. Each side has its own garage, which is not very common in duplexes of this price range.

In addition, every single inch of this property both inside and out was in superb condition. I mean, walking through it I felt very comfortable and at home; I’d love to rent here myself! My agent was pleasantly surprised as well.

The property is also nicely landscaped both in the front and back, including 2 nice wooden sheds, a back privacy porch, etc.

Lastly, one of the units has an unauthorized suite on the bottom floor. It is “unauthorized” only because the property is zoned for a duplex and not a triplex… otherwise it would be okay. Normally I am against unauthorized suites for the very small risk of there being an issue in the future, but in this case the risk would be even smaller since I could still rent out both sides even if I was told to stop renting out the bottom portion. It would still suit people in certain situations, such as a family with a teenage/20-something child, in-laws, etc.

The garage (which are actually finished inside BTW… bulkheads, drywall, lighting, paint, etc.) also contain lockable doors to both the upstairs and downstairs which means that I could choose which configuration would get the garage.

The unauthorized suite is both a pro and a con… it’s a con for the small chance that the city have a problem with it in the future, and a pro for the added rent! I should mention though that there are a few duplexes right beside this one though, making any “complaining neighbours” even less likely.

Overall, I loved this place and it’s now the strong favourite on my list. I think it is a bit premature to make an offer it though since it has only been listed for 2 weeks so far, and the holidays are coming up.

It is already priced pretty good so I’m hoping it doesn’t sell before it drops… I don’t expect a drop to be until mid-January at the earliest, and more likely in February.

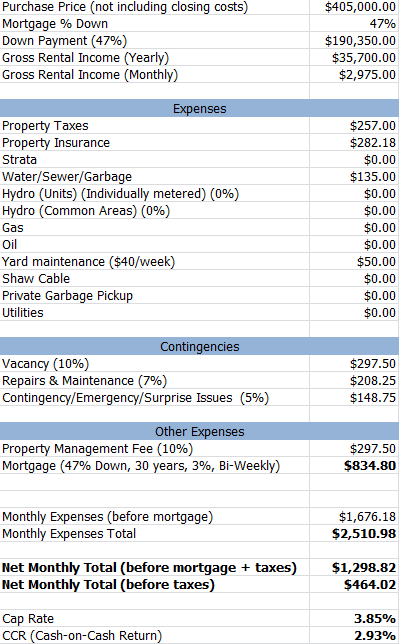

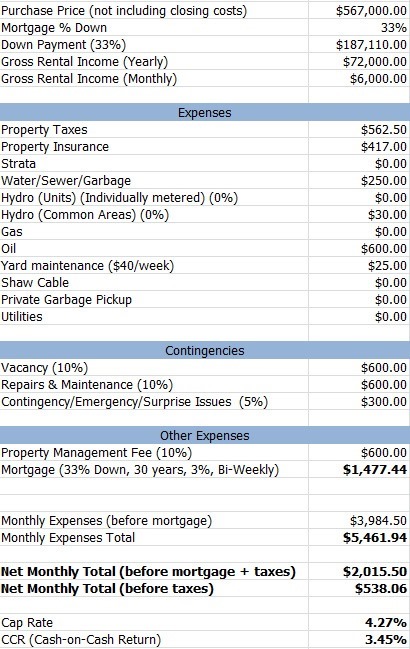

Oh, almost forgot – here are the numbers:

Property #6: The 8-Plex Historical

Boy, where to start on this one…

This property has been on the market for a while and never really tickled my fancy before due to its age, but with a very limited selection out there, I decided to take a look at it as the numbers on paper appeared to be pretty good.

It is a 114-year-old officially historical home that was converted to an 8-unit boarding house in the 1960’s. It was more recently converted into rental housing for the university students here.

It has 2 floors with each floor having a shared bathroom. That’s 1 bathroom per 4 units! Surprisingly though, even though they hadn’t been cleaned for a week apparently, they were pretty decently clean!

The listing realtor met us there to give us a detailed tour of the place which was actually pretty informative and helpful. There is also a separate title for the back lot which is zoned and ready for a 4-plex.

The age of the property aside (it had a lot of renovations over the years and is in decent shape, although there is obviously a lot more risk with an older building than a newer one), this property was really quite shocking to me.

We saw the entire building, including every single of the 8 units. Upon “entering” the first one, I was really in a state of shock, although I tried to mask it. It was tiny! I knew the rent numbers of the units going in, so I had a certain idea in mind what to expect, but just couldn’t believe that someone would be paying that much rent for what was quite literally just a room.

The tenant was there and seemed very happy living there though. He said he loved living there and that it was “enough” for him. All the other units were the same, more or less. Some were a little bit bigger and some a little smaller, but they were all just 1 single room with a closet and tiny kitchenette (literally smaller than an RV kitchen).

It’s funny because I was briefly discussing how I couldn’t believe how small the units were in my chatroom (some by and say hi), and one regular said something along the lines of “They are young college students – they’re probably elated to be living on their own”… and that is true! I forgot that when I first moved out of my parent’s place that I was just so happy to be going out on my own that the actual place didn’t matter all that much.

I’m old now and forgot that your first place is usually not a palace. Plus, these rental rates were like 60%~ of normal rates, so that does make sense too.

Anyhow, back to the property. The units themselves all seemed in decent condition, and there is a caretaker who would like to stick with the property who deals with all the tenants, cleans, keeps an eye on the place, etc. for an extremely cheap rate.

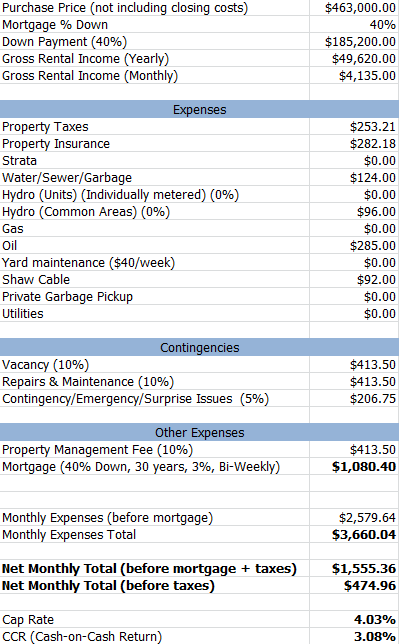

Numbers-wise, the place cashflows nicely. Here are the numbers:

In the end though, I think that this is a bit too much for me to tackle for my very first income property. It’s not out of the running, but I’d need it to drop in price a fair bit before I’d consider placing an offer on it.

Property #7: The Simple House

This one wasn’t all that interesting. It’s a “simple” small older house situated on a somewhat noisy street. It’s not really a real busy street, it’s just a bit loud – you can hear traffic drive by from the living room.

This house doesn’t have a suite, so it would be rented to just one tenant, but it’s a complete house with timber flooring and a yard and appears to be in good shape.

I wasn’t that interested in this one on paper, but as I mentioned before, inventory here is really low so there aren’t that many options out there and I thought it wouldn’t hurt to take a look.

The numbers are actually not too bad for this property, although my realtor has some reservations as to the traffic noise insofar as resale value.

My purchase price here, as with all the other properties, assumes a moderate reduction on the current list price.

If this property drops once or twice more, it may not be such a bad purchase… numbers don’t lie.

Property #8 – The “Full Circle” Property

Okay, so this one is a little interesting.

First off, it’s basically “slum lord” property. I don’t really like to use that term, but this is about as close to slum lording as you can get here. It’s a 10-plex property situated literally right behind a corner 7-11.

What’s interesting, and why I’m calling it the “full circle” property, is that I had actually looked at one of the units here back around 2005 when I moved out from my parent’s house and was looking for my first place to rent.

I remember waiting for the lady (I’m not sure if she was the owner or a property manager) to meet me there and her ending up being late. She then showed me inside and I immediately regretted my decision to consider this property. It was cheap, which is why I had wanted to check it out, but then I realized why it was so cheap.

Basically, while relatively decent inside, you could tell it was a recent cheap renovation – the way I remember it is with wood-coloured vinyl everywhere – the floor and even the walls. But mainly, it was just really small. The ceilings were really low which made me feel claustrophobic and the entire unit was just simply tiny.

Still way better than the 8-Plex historical units mentioned earlier (by far), but I just wanted to get out of there. I remember asking her a few questions just to feign relative interest so that I wouldn’t “hurt her feelings”, such as “I see I see… so… it is wired for cable Internet then?”.

And now, nearly 10 years later, I am actually looking at this place (the entire 10-plex, in fact!) to consider purchasing as an investor. Ha! Who would have thought? My entire blog was actually started to document my journey moving out on my own and trying to make a living from the Internet.

Now, this place scares me for a lot of reasons: the quality of tenants, the age and condition of the property (it needs a new roof right off the bat my agent says), and the location.

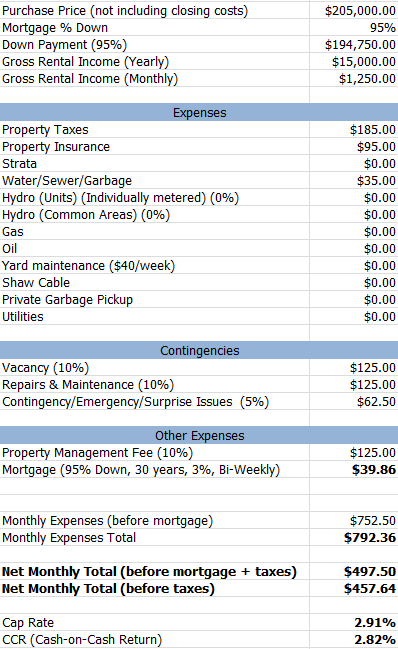

But do the numbers work? Let’s see:

They do. Damn. Heh. But are they worth the issues mentioned above? For me, no, they aren’t. For my first rental property, this would be pretty ambitious.

That being said, this place has had some pretty big price drops; it’s dropped by $100K since it was first listed, and it’s due for another drop. If I can get a deal on this place, I might actually bite the bullet and take the issues that come with a property such as this one. But I’d need to get a deal.

Property #8: The Sold Duplex

There’s really not much to say on this one.

Basically, we took a look to see it because it was on my list, but it just happened to get an approved offer that same day. We checked it out “just in case” and to give it a look-see.

It’s fine though, as it didn’t seem too impressive to me. Nothing special…

I won’t bother including the numbers on the property here since it’s most likely sold now.

So – there you have it. Another 5 properties looked at in person. There’s really not much else out there… there’s a few more, but definitely nothing that excites me.

I really love Property #5: The Ocean View Duplex. It’s just a bit of a difficult place to be with it only been listed for 2 weeks, and with Christmas coming up within a few days. The other interesting thing to consider is that a $15,000 difference in purchase price only makes a difference of around $40-$50 a month in cash flow.

But… that’s also a 30-year difference… so that’s $18,000 in profit (not taking inflation and raised rental numbers into consideration). So, a $33,000 difference over 30 years.

Loving these posts. Keep it up!

When will your coaching program begin and do you have a rough idea of the price?

Hey there,

Just stumbled upon your website today. Nice look and enjoy your articles with some great detail mixed in.

Thanks,

Christopher Pontine

I wouldn’t buy houses in Canada right now.

Greate post and content as always…:)

Hi Tyler,

I must have to say, your articles are simply awesome.

Regards,

Vinay Kumar

Hehe ! Great luv to read your content hope one day you will change this template 🙂

nice informative article.

Ok ..Finally understood that it is in Canada that you are planning to invest. Is is easy to get rid of a non paying tenant in Canada? In Europe is quite hard…

Especially if they are like single-moms or socialy deprivileged :/

When everyone is going out of the real-estate business, its exactly the time to go in head first! Wish you all the best Tyler!

Great posts learnt many things from this post