I Spent $70,000 on my Visa Last Month

July 23, 2012 Posted by Tyler CruzAt the end of April, I had mentioned in a blog post how I was looking to replace my credit card with one that had better perks.

My affiliate marketing campaigns were continuing to grow and I was spending more and more on my credit card.

I had a Visa card which had no annual fee and a 1% cash back reward. However, the cash back program had a very low cap of $25,000 a year, which meant that I could only ever earn a maximum of $250 from it per year, no matter how much I spent on it.

And so, with my credit card expenses starting to climb through the roof as I continued to grow my campaigns, I wanted to find a better card.

I did a fair bit of research and asked a lot of other affiliate marketers what cards they used, and the general consensus was that the American Express Plum Card was the best option for me situation, which paid out 2% cash back with no cap.

Unfortunately, I soon discovered that the Plum Card wasn’t available in Canada. In fact, Canadian credit cards in general don’t have as many perks as American credit cards.

I don’t travel all that much and so I didn’t want a card with air miles (even though I know you can convert those to things other than travel), opting for a cash back program instead.

The highest Canadian credit card I found was for 1.5% which was a Canadian Tire MasterCard out of all things. For you Americans who don’t know what Canadian Tire is, it’s basically like a Wal-Mart with the focus on the automotive section, while still having other department store general merchandise.

I thought about getting it, as it was the highest cash back rate I could find, but I was already using a Visa at the time and was happy with the customer support. This is important because I often have issues with my credit card getting temporarily frozen due to “suspicious transactions” being flagged due to all of my online transactions.

In the end, I just didn’t want to have my business credit card being from a department store.

The card I ended up going with was essentially an upgrade from what I had already been using: the Gold Elite Visa.

It is “only” 1% cash back and had an annual fee of $100 per year, but it has no cap.

In fact, the Visa representative I was talking to over the phone told me that just the other day, she saw a cheque go out to a woman for $25,000. That’s $25,000 cash back, meaning that she had to have spent $2,500,000 in a year on her credit card. It’s nice to know that there is really no cap.

In addition, the Gold Elite Visa comes with the a Deluxe Auto Club membership, which offers things such as travel insurance, and various automotive perks and benefits such as unlimited service calls 24 hours a day, 7 days a week.

While that’s nice, the truth is that all I care about is the cash back program. Basically, I upgraded from a $25K/year cap to unlimited.

This is a big deal though, because I’m on pace to spend a million dollars a year on my Visa. One percent of that works out to $10,000, so assuming things keep going as they have been, by the end of the year Visa will write a cheque out to me for $10,000.

Who would have thought that you could make $10,000 a year simply by using your credit card?

I used to do a lot of transactions with cash or debit. Mostly for my personal transactions, such as retail stuff. But ever since looking closer into credit cards, I now try to pay for everything on my credit cards.

It just makes sense, since you earn rewards. I now feel silly for not doing this before. Why did I even bother using my debit card to pay for stuff? Stupid. Oh well, lesson learned.

I Spent $70,000 on my Visa Last Month

Okay, now the first half of this post hasn’t really addressed the title yet, but I just wanted to share how I got a new credit card, as you may want to consider doing the same.

Getting back to the topic at hand, as I mentioned in the beginning of this post, my campaigns have been continuing to grow. June 2012 was my best month in affiliate marketing by far. It’s silly really, just how fast things can turn around in this particular industry (double-edged sword).

I’ve tried my hand at affiliate marketing for years now, off and on, but never really got anything concrete going – at least nothing too notable or consistent. Now I have a lot of various profitable campaigns and offers running, from multiple traffic sources.

In fact, super affiliate Richard Bonner encouraged me to give Facebook another try after he asked me why I wasn’t utilizing it and I whined that I was never able to make it work before.

This was in mid-June, so I’ve only been using Facebook for about 5 weeks now but have already spent close to $30,000 on it:![]()

My point is that I seem to be growing pretty quick, even on new traffic sources (I’m still a major Facebook n00b and don’t really know what the hell I’m doing).

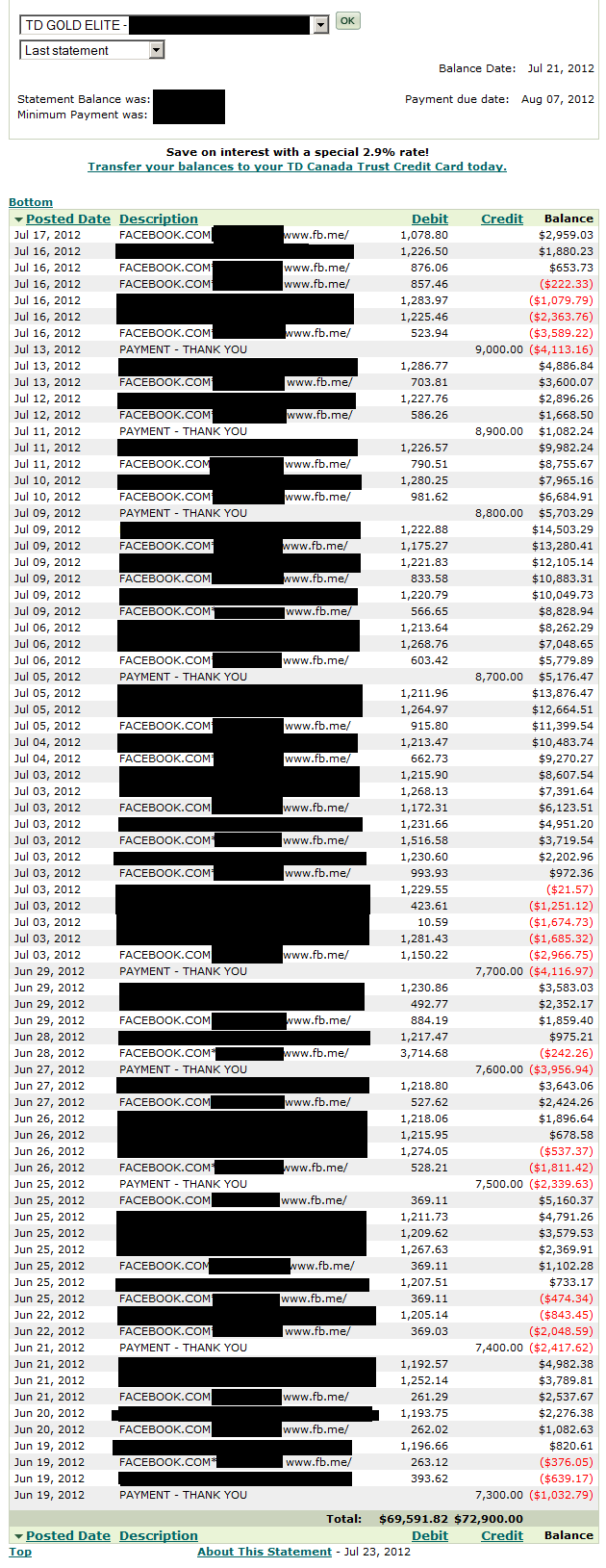

On my last Visa statement, it shows that I spent a total of $70,000 ($69,591.82 to be exact) during the period of June 19th – July 17th, so actually a couple days less than a full month

I should also mention that this is just for business expenses (mostly affiliate marketing), and doesn’t include any personal income (not that that would make it all that much more – I’m not Mitt Romney).

Here is a screenshot of my most recent Visa statement:

Crazy! 1% of $69,591.82 works out to $695.91.

That means that I effectively earned $700 just by using my Visa last month. I don’t get the cash back until the end of the calendar year, but that’s fine with me.

Future Growth

Affiliate marketing is quite a roller-coaster ride, and things can change at any moment; there are many up’s and down’s.

I can only hope that my campaigns will not only continue to run, but grow.

The bad news is that I took a bit of a hit just over a week ago with my biggest campaign, which dramatically reduced my ROI. I’ve since managed to micro-manage it to get it profitable again, but not quite at the same levels as before.

In addition, due to my OCD and sheer stubbornness (don’t ask), I completely overspent on my main Facebook campaign for like the past 2 weeks, continuously losing money (a lot of money) on it every day. If you in the other hand want to work on your finance, visit this website.

The good news is that I don’t have all my eggs in one basket, and in fact am running a fairly large number of offers and campaigns at various traffic sources to provide stability. I’m also making some pretty decent profit and am constantly learning things.

There’s still a billion things I want to test and try, but I am limited due to there being only 24 hours in a day. I hope that I can see some growth on my campaigns in the near future.

It would be awesome to start netting $30,000 a month. I never really thought that I’d be doing the numbers that I am right now, so I am hopefully optimistic that it’s not too unrealistic for me to achieve $30,000/month profit.

Wish me luck!

Nice job on finding a credit card with no limit on how much you can spend and get cash back on! will be nice getting that $700 check in the mail its about time I look into using CC from now on not my debit card plus it helps build your credit history. To your success Tyler!

Yeah, I don’t know anything about credit scores or history (anyone have an offer where I can look this up? JK) – I just care about the rewards. And you Americans have so many good options (Plum card, CapitalOne 2% cash back Spark card, etc.)

haha you just have to move to america like John Chow did & your next!

Too much paperwork 🙂 Otherwise I’d likely move to Florida.

Do it!

I’am half-way to Florida myself lol…

how much do you spend on facebook before you declare an ad a winner or not? i just finished trying to advertise an ecom product at a trial price, but wound up with a bunch of ads with horrible CTR.. nothing close to .1 which I heard is what is key?

what is your take on testing money with facebook? i’m about to go back into facebook now with a new campaign, i’m thinking of taking the PoF approach of testing 1-3k impressions/ad to determine CTR if winner or not across maybe 40-50 ads to determine if a campaign can work or not.

what do u think?

You shouldn’t really be asking me as I am a Facebook novice myself. With that warning disclosed, you’ll know if you find a winner or not – that is quite simple. I judge on whether something will work or not more on conversion rates and EPC than on anything else. Then I can work from there and try to get my eCPC’s down. With your method (focusing on costs first), you could work on getting your eCPC’s down to $0.09 only to discover that your EPC is $0.08…

From what I’ve read, BTW, 0.15% CR on FB is the rough standard for a good CTR, not 0.10%. That being said, my CTR’s are usually far below that as I tend to target huge demographics as I’m only interested in stuff that have scaling potential.

To sum it up, I focus more on an offer and ad’s CR and EPC rather than its CTR and CPC, as you can always optimize the latter but have little flexibility in optimizing the former.

Your math is wonky. “That’s $25,000 cash back, meaning that she had to have spent $250,000 in a year on her credit card.”

If it’s 1% back, that means she spent $2.5 million. To get $25k on $250k in spending, the credit card would have to offer 10% cash back.

Sorry, you’re right. I told this story to somebody else before and said 2.5 million… this Red Bull isn’t kicking in! Edited.

how much profit did you make? if you don’t mind

Hey Tyler,

Keep the stats filled blog posts coming – they are awesome to see and read!

It’s so awesome to watch you kicking total ass!

Thanks again,

Jon

Glad to hear that you got the Gold elite card – it’s a great card. Awesome customer service, along with all of the other perks..

Posts like this are fun to read but it would be a bonus to see what your profit margins are…

What offers are you running? If you’d rather not share that, what network is it with?

Yeah, I’m not going to share what offers I’m running. I use PeerFly and a number of other networks.

Very inspirational buddy! Keep it up 🙂

Can you share some information on landing pages 🙂

I cannot, as I don’t use them 🙂

I did once upon a time, but not anymore, although I might give them another try…

Was there any particular reason why you stopped?

WAY too time consuming. Not just to throw them up and manage them, but for optimizing and tracking reasons as well. Also, offer LP’s have gotten a lot better throughout the years…

Could you share your traffic sources?

This is very interesting post Tyler and full of information.

I wish you to get that $30000 profit a month.

good luck

Better hope you get paid by the networks 😉 🙂

That is too bad that Canadian cc’s don’t have the same or similar perks as the US cards do. I can see why you were wanting to find a different card though. I am with you as well on not wanting a card that is from a department store.

Hospitalized , passed away !!! What happened ?

[…] finally, we have Tyler Cruz talking about his spending habits. In fact, he charged $70,000 on his Visa last month. These are all business expenses and they earned him 1% cash back ($700). I say that if […]

Isn’t the Gold Elite a personal card though? So you’re using it for your business expenses?

Of all the choices to choose from, you pick the TD card that requires an annual fee? Mastercard and visa are basically the same when it comes to paying for things online so there’s no real comparison there.

MBNA’s smartcash card is 1% back, no annual fee.

If you get the capitalone Aspire world card, it gets you the equivalent of 2% cash back for travelling and gives you a $350 sign up bonus. Sure there’s an annual fee, but they also credit you with enough points that the annual fee is effectively $20.

If you sign up for the RBC avion card, you can get travel rewards, convert to BA points at 1.5x and go crazy.

These all give way better returns than that TD card.

Great to hear this Tyler. So inspirational – I hope to one day achieve this sort of status.

That’s amazing Tyler! Keep up the good work. Wish I knew you more on a personal level. 🙂

What do you think the biggest difference is between when you weren’t that successful with affiliate marketing and now?

Does it just come down to testing more offers and more traffic sources and seeing what works (like throwing mud against the wall and see what sticks) or is there something else you noticed?

That’s basically it. Just have to keep at it and find something that works. I didn’t really change much in terms of “technique”. So much of it comes down to luck.

First time to visit your blog. I read your inspiring post at john Chow blog. I hope to one day achieve this sort of status.

Good luck tyler. Wish you can get $30K per month. BUt to paid $70K on month using the Visa is terrible. Maybe you need to stop the facebook campaign first.

That’s impressive! And actually a really good idea. It really does take money to make money. I’m curios to know what form of advertising you find to be the most effective. Have you experimented with advertising on Twitter yet?

Tyler,

It’s great using credit cards to pay for all this stuff because of all the rewards you get. Nice work.

Hi Tyler,

Good job, it’s important that you find the low-income as well and not looking after the whole time. But be careful with Facebook, I know several who have tried Facebook but with poor results.

It really has been interesting to see your growth over the past year, if you had one bit of advise to people who are trying to achieve what you already have, what would it be?

wow , Glad to hear that you got the Gold elite card – it’s a great card.

can you talk a little about your profit? if you elimianted all of your negative capaigins, what’s is your profit?

Crazy affiliate spending. I wish you the best in your fb campaigns

looks like something fellows like us may have missed out. I spent alot on my credit card for online marketing but i never thought of getting a card with cash back.

Guess it’s time to give my bank a call.

More vague bragging and no info just shut the fuckin blog down already.

can you even call it bragging when it only gives you total numbers and not profit?

Wow, 70k?! What is the monthly spending limit on that card? How did you get the limit to be so high?

The monthly spending limit I think is $15,000.

Wow! Seems like your affiliate marketing efforts are actually, really starting to pay off! – I’ve been following your story for a long time and only now decided to comment here.

Keep this up!!

When you spent $70000.00 in one month, do you have to pay it back next billing period, or you can keep balance without interest charges?

My credit limit is far below $70,000 – that is just how much I spent. I regularly make payments to my credit card so that they are usually owing ME money.

Hey Tyler,

I am just wondering why you have blacked out the CTR, CPC etc?

I don’t see there being any competition…

Just wondering as it might be something I should do myself 🙂

What do you mean by there not being any competition?

What happened to Tyler?

Everything has a downside and I think you have not seen it yet with Facebook.

What d’ya mean?

Show us a news link or something…

Thanks Andrew,

Yup. Looks like spammy comments designed to provoke controversy.

Back on topic; I think that profit figures or at least ROI are important in any case study, especially with FB CPC prices going up in countries like USA. Otherwise, just saying I spent $XX,XXX means nothing except acting as newbie bait.

Nice shares Tyler…I’m happy that you decidde to try Facebook again and I hope that you wiil share results like you did in the past..Cheers!

Hi Tyler,

I need small advice,I know that you are novice in facebook ads but I belive that you could help me…

I have one winning offer on fb but I am paying small bid (cpc) and because of that fb doesn t showing my ads very often.Is is possible that I increase my impressions without increasing my bid?

Thank you

Setting your daily budget on the campaign has a big effect on how much traffic you receive…

That’s a nice looking credit card. Mine looks so plain compared to it

So Motivational, I Appriciate you So Impresiive.

Haven’t found much about facebook affiliate compaign. Wonder how it compares to ordinary website ?

Now I want to see an update of the article and the outcome of the Visa Card payback percentage.

I only get paid once, at the end of the year…

Did tyler pass away?

WOW… i always get so inspired reading your posts!!!! So are you mainly using Facebook to promote your deals?

The more I read the article, the more I want to know the results of Gold Elite Visa will pay out so much money to you without some strange deductions.

Looking forward to an update on this. That’s a ton of money to be racking up on a card.

Wow! Impressive! That might even make me consider using a credit card again. I also agree with the above users about stats filled posts, keep them coming, makes a significant difference in my opinion. Thanks for the article.

Regards

Is this the end? 🙁 don’t see any updates any more.

On what?

Saving money is the cool thing to do!

when you are using an offer through peerfly are you direct linking or using a landing page? can you make the same amount of money either way??

I mainily direct link these days.

Would you care to share maybe one traffic source before you used facebook Tyler? I’m kind of starting out also and facebook is out of my reach.

Hi Tyler and other marketers,

May I know how do you get a credit card that has more than 2k limits at the first place? I mean credit limits are usually determined based on one’s salary, right? But as an affiliate marketer, do you found a paper company and record all the earnings to that company?

Thanks.

I don’t really understand your question… yes, your credit card limit is usually based on your history and salary… but you shouldn’t be needing a huge limit anyway. You should be keeping your balance at $0 or with a credit owing to you.

Oh Tyler I didn’t know one can deposit money into the credit card and have a balance owning to myself! Haha thank you for your answer!

Yeah, you could spend $100,000 a month on a credit card and only have a $2,000/month limit.

Facebook should love you!

Never saw credit cards as a way to earn money. Very interesting.