My Completed Income Tax Reports

June 25, 2010 Posted by Tyler CruzRemember how my office floor was littered with tax documents, receipts, income statements, and other paperwork a couple months ago?

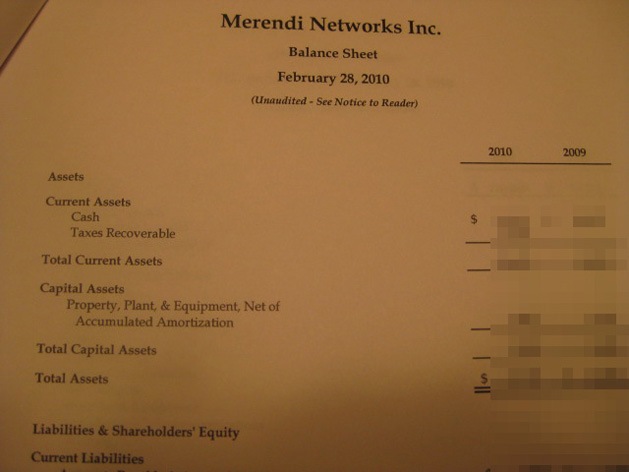

Well, after organizing both my personal and corporate year-end’s as best I could, I dropped them off at my business tax accountant bondi junction office. 2-3 weeks later, my accountant was done and I only had to drop by to sign some paperwork. He handed over two envelopes, one for my personal taxes and one for my corporate taxes, and each of them contained a report of my income taxes and all the organized paperwork done for me. All I had to do then was write them a cheque and file my taxes away in my filing cabinet.

I’ve been using this accounting firm for 4-5 years now, and it’s the second year they’ve done my corporate taxes. I made this post to show those of you who don’t get their taxes professionally done what you can expect to receive by doing so.

Doing your personal taxes is easy enough these days if you have a “normal job” due to all the tax software programs out there. After all, all you really have to put in is your T4 information and that’s pretty much it. But if you run a business or corporation, then doing your taxes is going to be a much larger headache.

Using a tax service company (or better, an established local accounting firm) can save you countless hours and stress (not to mention possible errors which can haunt you in the future).

Below is a short 5-minute video showing what I get back from my accountant once my taxes are done:

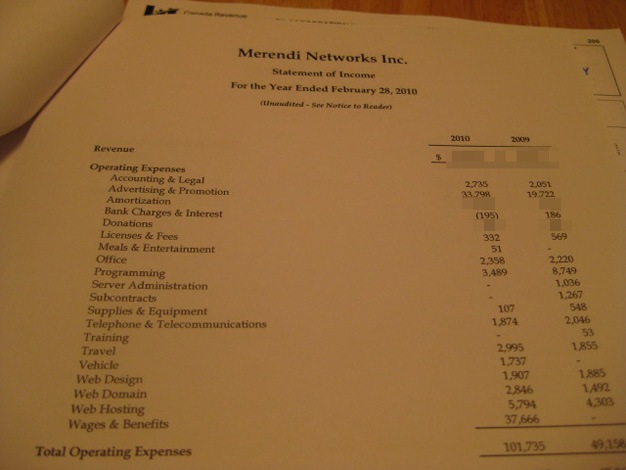

Here are a few photos:

Below are my completed corporate T2 forms. Imagine doing all that yourself! No thank you!

Yep, it’s *definitely* better to have an accountant do it all for you. It’s such a hassle doing it yourself, and you usually get more deductions if you have an accountant do it for you.

I totally agree. I used to do my taxes myself and it was so stressful dealing with the multiple forms and excessive calculations. It is so much easier to make a basic spreadsheet and give that to a professional accountant. I know if it’s all up to me I’m likely going to miss a lot of potential deductions and make other mistakes.

It’s much easier to have a professional do your work for you. Besides, they know all of the loopholes. We pay far too much taxes in Canada.

A lot of people shy away from Accountants due to the cost. However, most people dont realize that an accountant can SAVE you money.

My father stated that I shouldn’t register myself as a corporation because corporate taxes are so High. Right now I’m only doing about $1200 a month through Clickbank, so not sure if it’s even a big deal. But once I get up to the $5000 level, should I still maintain myself as a sole proprietorship? I mean you get that W2 form or whatever from Clickbank. My dad’s accountant handles my taxes as well, so I’m not too sure what’s going on.

The main point of incorporating is to take advantage of the low corporate income tax rates. If where you live they are higher than as a business or sole proprietorship, then you probably shouldn’t incorporate. I incorporated once I hit the $100K mark as that is when it started to make sense financially for me to do so. Here, the corporate tax rate is FAR below what I would be paying personally (in those upper tiers)

Thanks so much. Yea I’m in NY. I’m also looking into incorporating in another country all together, and moving there. The question is that if I’m living overseas, and I’m an American Citizen, do I have to pay any taxed to the american government at all? If you have any knowledge in this, it would help. Thanks.

I’m not a corporate accountant, and I also have no idea what the corporate tax rates and laws are in the country you’re moving to are, so my advice is to ask a qualified (and properly certified) corporate accountant in that country. That’s what I did… I sat down with the firm’s owner (who was the lead accountant at that time) and asked him a billion questions. I think he charged me like $50 for the consultation (by the hour).

Don’t ask me though, that’s for sure 🙂 Talk to an accountant there and he should be able to tell you everything you need to know. Good luck!

Thanks for your honest advice. You’re the best!

As a US citizen, you still have to file a return every year regardless of where you reside, and you have an tax exemption if you make less than $85,000 or so, give or take.

If you’re moving overseas for business reasons, how about renouncing your US citizenship after getting the citizenship of your new country?

Thanks Vic. I dunno I want to change citizenships. Still thinking.

Getting another citizenship/passport besides your US one is still a good business strategy as there are a lot of overseas banks that will refuse to take and serve US citizens/residents as the task and cost of compliance is onerous and not worth the effort.

Flash a non-US passport however, and doors will magically open.

Renounce his US citizenship? That sounds pretty looney to me. I don’t care what country in the world I might want to live in, My Canadian citizenship is far to valuable for me to ever consider renouncing it, and I imgine that most American’s would feel the same way about theirs.

Renounce his US citizenship? That sounds pretty looney to me. I don’t care what country in the world I might want to live in, My Canadian citizenship is far to valuable for me to ever consider renouncing it, and I imgine that most American’s would feel the same way about theirs.

Jonathan said it – I was thinking India. I love the place. My family is from there. But an American citizenship is valuable. I was born and raised here, and start to really understand the value of the freedoms a U.S. Citizen enjoys, when I’m staying with my family in India. Saving a couple of bucks isn’t enough to renounce my citizenship.

But Vic, your feedback was great. Thanks. Gave me lots to think about.

Good info, Tyler. Again, you’re one of the few bloggers/internet entrepreneurs who ever bother to tell anyone about the “nitty gritty” business stuff … but it’s really important. It’s also really hard to go back, after t, and restructure things, so it’s much better to start dealing with things properly from the very early days of earning.

An accountant who even knows which end is up with affiliate marketing and income producing web sites is a real asset to your business … treat them well.

Yea I’ve stuck with an accountant for a few years. I can’t imagine trying to do things on my own anymore – and yea there seems to always be a whole lot more deductions that my accountant finds which helps out a lot.

wow! that contains pretty good number of pages.it really makes a book.i would beat my head on the wall if i have to go through so many documents

An excellent reminder of how important it is to get a good accountant. Very few people in our country consider this, and I’m glad that you made this post so I can share it with people I know

Looking at one of your statements, you should really take more advantage of the “Meals & Entertainment” section for tax benefits! That’s one of the things I find great about being a corporation, is that you can write off so much more! But then again… I am no expert, and your accountant probably has it all figured out, between your personal and corporate taxes.

Till then,

Jean

Nope, you’re right. He told me I should be spending WAY more on that, haha.

I’ve also been advised to claim more in that area, but I just can’t be bothered to make up excuses about how each item related to business. It is quite tempting to save the more expensive meal receipts and claim them.

So I guess I am learning something after all at college 😉

@Laptop, you should really start to!

Till then,

Jean

Wow…that’s a big tax return. Wouldnt want to do that myself!

That contains pretty good number of pages. 😉

Hey Tyler,

Im not an accountant either but if your earnings are purely by the web you can also try doing an offshore account, which i have read you can save some money on your taxes.

Nahh, they can’t be trusted all the time. Just think of working miles away from you and what ever may happen they can’t be there all the time.

I’ve heard good things about offshore accounts – it’s something I would be looking into as well. Perhaps you should move to a tax haven – there are plenty of them out there 🙂

I will consider incorporating my online business once it hits a certain income as I will be able to put what I have purchased for my online business as an expenses for the company. As an individual, these purchases will not be considered into the whole tax calculation.

You will spend much time on that Buddy. I advised you to have your own accountant like Tyler did.

Good information Tyler. Depending on how much you are earning and how big your business is you could prepare the statements yourself (if you have some accounting background). Otherwise getting a professional accountant would be the best option and save you “the stress” like you mentioned!

Well, I have a friend who is accidentally an accountant lol. I owed him a lot for processing all these stuff for me.

Good thing you’ve accomplished all these. Mission completed!

I find great about being a corporation, is that you can write off so much more! But then again… I am no expert, and your accountant probably has it all figured out, between your personal and corporate taxes…

Good for you to fill the tax form.

It ain’t easy even we use system. Need to honest fill it… 🙂

Good advice Tyler – I have done my own the last few years but will definitely be using an accountant for this coming tax year – do you think using a chain like H+R block is fine?

I wish I had a real company. Those tax reports look really professional 🙂

I completely agree with you. Although accountants can seem expensive, they can take away both the hassle from filling out countless forms and also the worry of being penalised for making a mistake. A few years ago I thought I had made a mistake in my tax forms that could have cost me a lot (thankfully, it was nothing). I have used an accountant ever since and haven’t looked back.

Thats a lot of pages, it would probally be a pain to do it all yourself. Its always great to get an accountant to do it for you.

Good Point, when it comes to hiring Accountants, which I had my fare share, make sure you check his references, cause a bad accountant can cost you some serious money.

I would have to agree with this one. I’ve had a bad experience with an accountant that cost me $14k on a property deal due to incorrect financial structures being set up. It hurts – let me tell you.

I certainly wanted some guidelines to do my business ,anyway this is wonderful idea,Thanks

Loved to know that finally You are organized.

Talk to an accountant there and he should be able to tell you everything you need to know

You need to do a post on overseas tax evasion lol

Yea..I’m Back People..

Taxes are an big headache that breaks me down every year. Thanks god i’m an in order person who likes to keep things where they need to be.

My first year online I made $19,837.79 for 2002, so I didn’t really need an accountant at that time..but know I’m do many numbers better than that…I decided to hire an local company just like you Tyler to handle that stack of mess.

Boy Uncle Sam loves us marketers..

I’m Out Tyler..how the weather up there this time of the year?

Yo Tyler

I took a look at his book sometime back and I said it will be an good book to add to my collection. Yes I know mostly everything about blogging, but I still want to support John book.

This will definitively be an good read for my readers of my blog, so I best get an whole of it and offer it to them also

Keep the great content coming Tyler.

“TrafficColeman “Signing Off”

Good for you to fill the tax form. 😉

do you think using a chain like H+R block is fine?

I think it’s fine, yes, but I think using a local accounting firm is preferable. And I’m not sure if H&R Block will do corporate accounting…

Good information Tyler. :O

heh…that must have taken a while. It’s almost like the government wants to discourage small-scale entrepeneurs, sometimes.