Affiliate Landlord: Hitting the Streets – Tour #3

April 11, 2015 Posted by Tyler CruzFirst, a very quick health update:

So, less than a week after posting that my health was much improved, I had a major relapse with my Meniere’s Disease and whatever the hell else is wrong with me.

I went to the doctor again and he’s a bit concerned, saying that there’s a bunch of “red flags”, and he scheduled me to get an MRI of my head. I’m waiting to receive something in the mail to know when my MRI is actually scheduled for – if it’s too far down the road, my doctor will get me expedited for a CT scan instead.

I’ve recovered well over the past few days, but there are still definite problems with me.

Anyhow, enough of the depressing stuff…

New Blog Post Category: Income Properties

I’ve added a new post category to my blog: Income Properties.

All my appropriate past posts have already been moved over, and all future related posts will be categorized as such as well. You can view my posts by category on the right sidebar of my blog.

The Third Tour

It’s been a while since my last physical tour of properties with my real estate agent. In fact, the last one was back on December 18th, 2014!

The market here, as I’ve said many times before, has just been a complete seller’s market lately and there’s been nothing half-decent to look at.

However, a very interesting property popped up a few days ago and I was pretty keen at looking at it, and so I made a list of 3 properties to go take a look at in person.

The Hospital 6-Plex

I wrote about this property a couple of posts ago, and I put it on my list of properties to look at as even though it didn’t cashflow with my numbers, it would cashflow if I managed it myself.

Unfortunately, it was just sold. I told you – seller’s market here.

To be honest though, I wasn’t all that disappointed. I mean, I was a little, but this place was always a bit ambitious for my first income property, and again – the numbers on it weren’t great.

I can’t wait to find out how much it sold for though…

I need it to drop again before I go take a look at it in person though

The School Duplex

I also wrote about this property in that same post.

So, I basically decided to look at this in person because I would only be interested in it if it was in superb condition, since it only cashflowed at $270 a month.

So, the result? Well, let’s just say that there’s a reason why you need to look at places in person.

First off, the building itself is a lot older than I thought it was. Both sides had an ancient looking furnace which neither side used; they used small space heaters instead. That actually isn’t a horrible idea either, since both sides were even smaller than I had thought – and I already thought they were small to begin with!

I mean, the trailer I lived in for a while as a kid was bigger than each side I think.

The kitchen on the first side was in really bad shape too.

The second side was resided by a hoarder – my first experience seeing a hoarder property in person! However, the side was actually the better of the two if you erase the clutter from your mind.

The interesting thing about this property is that it has a very large, flat back yard that is completely unused (just grass), and it backs onto a lane which means that it would be a perfect candidate to build a carriage house on. Unfortunately, since it’s already a duplex, local zoning laws wouldn’t allow for this.

Since the property is in poor shape and doesn’t cashflow too well, this is now off my list.

The 2-House Property

So, this property was the main reason I requested another tour with my agent.

It’s a new listing, only going live on the market a few days before booking the viewing, and is an older property. In fact, I knew it was old before we went to look at it, but I didn’t really realize just quite exactly how old; I thought it might be 1950’s or 1940’s, but apparently it’s likely at least 1930’s. The official age is listed as ‘unknown’.

And the age really shows itself in the construction. It’s lath and plaster interior for one thing – which is pretty much the norm in older houses here, and I’ve never done any repair work on with that before, but that’s not the end of the world. I would have to get in touch with a residential or commercial interior design service to make it somewhat modern.

The “basement” is a separate entrance and only about 5.5 feet tall. It has a gas water heater and furnace, and the washer and dryer are there as well – which must absolutely suck when raining and snowing (I live in Canada remember). It’s not nice down there and you don’t want to be there for long. In fact, as we were leaving, the bottom frame of the door was so rotten that it basically moved and nearly disintegrated. This was likely due to there being no awning over it, but it gives some hint as to some of the building’s condition and age.

I guess I should mention now, that this listing is interesting because it actually contains 2 separate houses on the same lot. The house I mentioned so far was the main house (house #1), and there is a slightly smaller one in the back which is legal non-conforming house.

What this means, basically, is that the house was built prior to municipal zoning changes, and is therefore allowed to grandfather in older laws that allows it to be legal now. I couldn’t tear it down and rebuild a new house there, for example. However, my agent told me that there are some loopholes that investors use here; primarily that you’re allowed to rebuild up to 75% of it at once without it being considered an entire teardown. Then you do the other 25% later, heh. All legal and compliant. ![109[3] 109[3]](https://www.tylercruz.com/wp-content/uploads/2015/04/1093_thumb.jpg)

So, this property is kind of unique in that it already has a carriage house in the back and is legal, making this a great real estate investment property set-up.

Getting back to what I was saying earlier regarding the old condition of the main house, there are two more downsides.

First, it’s situated in front of an old highway, so there is some noise from that, and also means that the access to the properties is through a narrow back lane which is a little bit sketchy and awkward.

Secondly, the area itself is definitely one of the least desirable areas in my city. It’s pretty comparable to the Hobbit House – if you’re up-to-date with all the properties I’ve been looking at. It’s maybe a 5% – 10% better location than there.

Apart from all these negative things, the main house was otherwise in good condition it seemed. In fact, I was surprised how nice the bathroom was for a house of that age. It was obviously recently renovated. Both properties have newer roofs on them through residential roofing repair, and if they are fiberglass, my realtor says they should be good for another 18 years. Searching for roofing companies near me. Call Overson Roofing in Arizona.

Both properties share a nice yard with some fruit trees, which is fully fenced and even split between the two properties. There’s even a single-car carport out back as well.

As a bonus, both properties actually have a half-decent ocean view; Google maps shows the distance to be only about 1200 feet from the ocean!

They both appear to be independently metered as well, and the tenants in the 2nd house have apparently been there for 4 years! That’ll cut my vacancy rates! In fact, I only put 7% in my numbers because of this. Even then, 7% is very conservative.

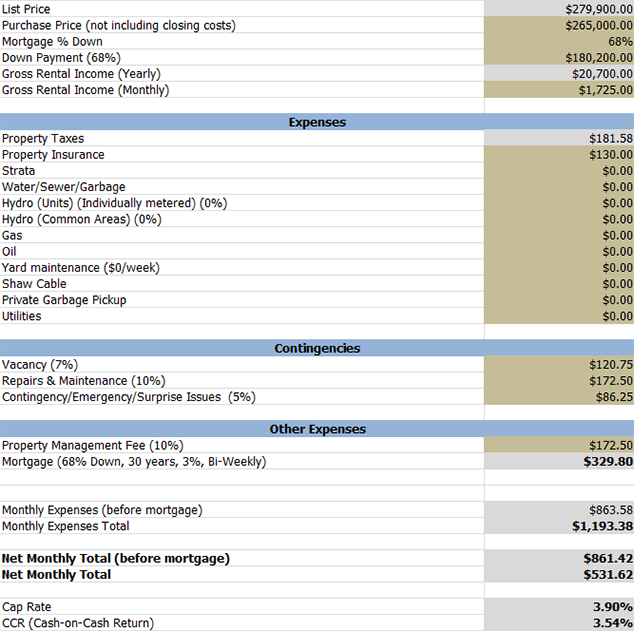

Here are all the numbers:

As you can see, even after all my possible expenses are covered (save for one-time closing costs; I’ll be adding those into my equations soon), this property has great cashflow, coming in at $531.62/month.

That’s a 3.54% ROI for life, not factoring in equity gain (once it’s paid off, it’ll be 5.74% ROI for life for example) or appreciation.

If I pay it off early, not counting early payment penalty fees, which I could easily do with a few great months of affiliate marketing, even after all my safety padding expenses, I’d be netting $861.42 a month for life, again not factoring in any appreciated value/rent. As my realtor told me, “Rents will increase with inflation. Your borrowing cost will decrease with inflation“.

It’s not $30,000 a month like you can make in affiliate marketing, but it’s also a very stable and dependable income I can expect each month, unlike affiliate marketing which is highly volatile and may only last one month.

So, on paper this property works. This is assuming $15K off the listing price, and not factoring in closing costs, but I’m also using a higher mortgage rate in my numbers.

I dunno. It’s old, and already in need of some repairs. Nothing major though. It’s not like the Oceanview Duplex that was sold before I had a chance to place a bid on – that property was in superb condition, no question, and cashflowed greatly. This one cashflows nicely, but is old.

Should I wait for something better to come around, or have I waited long enough? I’ve already been looking for around 8 months now…

What are your guys’ thoughts?

In my next post, which I’m going to start writing immediately after this one, I’ll be showing off some income property analysis tools I’ve been working on ![]()

I will most likely publishing it in 48 hours, so keep an eye out for it.

Take this with a grain of salt as I know little about property but sounds like you have a great deal on your hands if you can get it for $265,000. Especially because the second house has had tenants for so long.

Would hate to see you write another post in a few weeks or months and say it’s taken and you should have made the jump like last time.

If the numbers work for you, they work.

Awesome update buddy 😉