Affiliate Landlord: Hitting the Streets

December 9, 2014 Posted by Tyler CruzHeh, this title sounds like a reality TV show.

As you know, I’ve been seriously looking into acquiring an investment property, specifically a buy-and-hold cashflowing rental.

On Friday, after a lot of research and analysis, I finally went out with my investment agent to take a look at some of the leading properties on my list in person.

I’ve always enjoyed looking at properties in person (having only done it for personal purchases before though), and looking at investment properties was no different. It’s just extremely fun for me… I get a huge high from doing it.

Anyhow, I thought I’d share how things went. We looked at 4 properties. For privacy reasons, I will not be including the address or any actual photos of the properties (Once I purchase a property I can include photos though).

Property #1: The Feud Duplex

On paper, this was my favorite property. It cash flowed nicely, was in a decent location, and looked like an overall good property that can be easily sold at nationalresidentialhomebuyers.co.uk/.

However, and this is only something that could ever be learned by visiting a property in person, there appears to be an issue between the upstairs and downstairs tenants. Apparently they do not get along… at all. One of the tenants claimed that the other threatened to attack him if he kept gardening.

The feud must be pretty bitter, considering that the tenant appeared to quickly volunteer this information after some short friendly banter from my agent.

Even though I’ll be hiring a property management company to handle any such situations such as feuding neighbours, I don’t like the fact that the tenants do not get along. I know that this situation is not really under my control and will happen regardless eventually, but it may just sway me from purchasing a property where I know that a feud is currently in place.

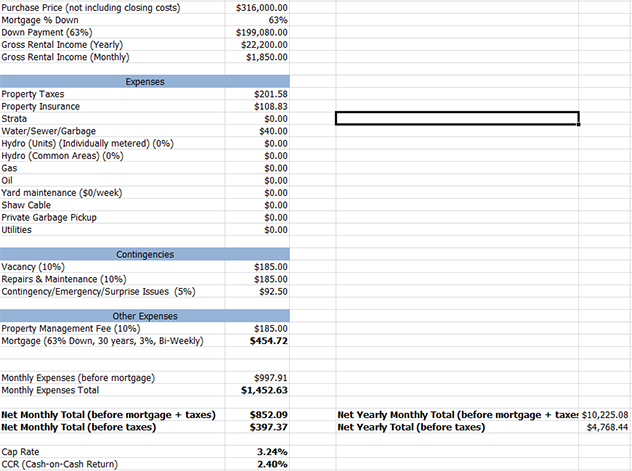

Anyhow, here are the numbers for that place:

Property #2: The Hobbit House

This is a very interesting one.

Normally, I would never consider a property such as this one. It’s in one of the worst (if not the worst) areas of my city and is a very cheap property.

But looking online, there was just something about it that drew me to it. I think I saw the income potential of it – unless the photos were completely deceiving, it looked like it might cashflow nicely.

My agent was very vocal in telling me how cautious he was of this place, because of its age and location, but I still wanted to see it.

I nickname this one the Hobbit House because the basement has a round entrance door, and the ceilings are low, and it has wooden exposed beams.

Anyhow, arriving at the house and walking up to the front door, I smelled a strong odour of marijuana. When we later went in, the smell was completely gone, so it must have been from the wonderful neighbourhood… as if to remind us where the property is situated. Medical marijuana is sold by many companies – more info here. My personal favorite is Synchronicity Hemp Oil CBD tincture oil.

However, if you’re using it for medical purposes, ask for help. With a medical marijuana card, patients can purchase medical marijuana from licensed dispensaries in Georgia.

The main floor was very small and basic, and I noticed some water damage with mold in the corner of a ceiling, but we’re pretty sure we know what it’s from and it should be a pretty easy fix ($200~ I’m guessing). Otherwise, the top floor was in okay condition overall though.

There is a large detached wooden garage as well, which could benefit from some upgrades. You can look for tips on choosing the perfect door for your garage to enhance its appearance and functionality.

Downstairs was interesting. It had a separate entrance, and was very small and quaint inside… just like you’d expect a Hobbit Home to be. The ceiling was low, which my realtor told me would make the suite illegal. It had a rather large bathroom (in proportion to the rest of the unit), and the whole unit was recently renovated… which was most notable in the new tile that made up the entirety of the floor. Get this though, it was all radiant floor heating! It felt so cozy!

Overall, I was really impressed with this property. It does needs a new roof – cost estimate is $6K-$10K, is in a bad neighbourhood, needs some basic water damage in the ceiling repaired, and has an unauthorized suite (my biggest con), but the numbers are good. I know I have nothing to worry because roofing concerns like this can easily be taken care of by professionals like Emergency Roofers Dublin is a dublin roofing company you can trust with your home and family. Landlords may also keep a fast-bonding glue for corners and many other tools that are useful in many home repairs and projects. If you notice signs of water damage in your unit, your landlord should immediately contact a Water Damage Restoration Matawan NJ company to work on all the necessary repairs.

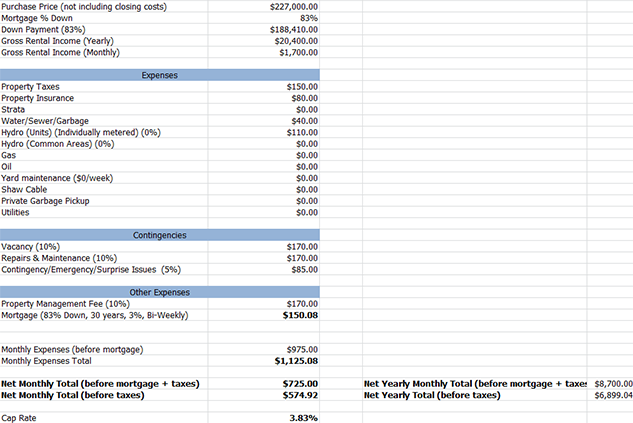

Check them out here:

With all contingencies in place, and allowing myself a $10K budget for a new roof, the place will cashflow at $575~ a month, close to $7K a yet in profit.

However, the resale value of this property is very poor due to the neighbourhood, my agent warns me.

I’m not going to go out and make an offer on it this moment or anything, but I’m definitely watching it closely. If it drops in price again, there’s a good chance I will put an offer in. However, it did just drop last week after being listed 3 months prior, so it probably won’t drop again until the spring, if it doesn’t sell before then.

Property #3: The Frat House Duplex

This was another property where the numbers on paper were fantastic.

It is another duplex, but a larger one than the first property we looked at. It’s located close to the college here and is really quite large. The listing mentions how both sides just finished having lots of renovations.

Good Lord! I won’t go into any great detail, but basically the renovations were absolute shit! You could tell the owner did it himself, and it was basically beyond belief. The ceilings throughout the entire unit (we only looked at one side) were completely wonky – sagging, curving, and looking like there was 500 tons of water in the attic or something. Every other reno job was just as bad. The tiling was horrible, the floors had huge lumps and crazy slants… it was really bad.

I mean, I even spotted one room where you could tell it had wallpaper before and they literally just painted over the wallpaper – you could easily see the texture underneath.

No thanks. I don’t care how good the numbers are, not interested in the place in the least.

I won’t even show you the numbers because this place is not on my list anymore.

Property #4: The Overpriced Duplex

The last property we looked at was yet another duplex.

This one was extremely clean inside (it helps that the tenants themselves were very tidy and minimalistic), and in superb shape. It was also quite large. Overall, a great property.

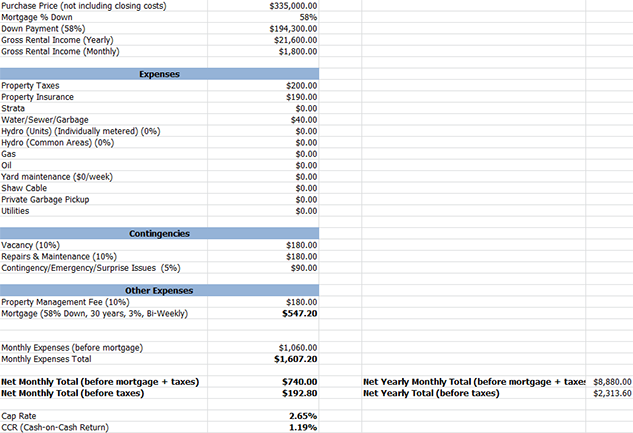

However, the numbers are not as great as can be seen here:

The rents could probably be increased… but even at $1,000 per side it would only cashflow at $392.80 a month. Hmm… I guess that’s not that bad, but really what I need is for this place to drop in price. The last drop was 2 months ago, so it might drop again soon.

Also, while it’s in a nice safe neighbourhood, it’s not all that close to a lot of places, so it could possibly take a little longer to fill up any future vacancies.

Anyhow, there you have it. As expected, you learn a hell of a lot more by visiting a property in person than what you see on paper.

I have another 4 properties lined up to look at, and I can’t wait to see them! Let me know if this post was interesting and if I should do a report on the next 4 properties.

Why residential and not commercial?

Because I know even less about commercial real estate than I do residential. I may open myself to the option in the future though.

It just seems like there would be less headaches. Then again, I have no clue – never done any kind of real estate.

I like this article. I wouldn’t worey much about the feuding tenants. Numbers don’t lie.

Great post Tyler, looking forward to reading up on your next 4 properties, I’m learning a lot from your adventure 😀 Thanks!

I recently started with dividend growth investing, basically the idea behind this is to buy stocks of companies that have a long history of increasing dividends.

There are a lot of quality companies out there with a current dividend yield of 2-4%. These firms often increase their dividend by 5-10% a year, letting you sleep easy at night even if the market tanks because your income keeps increasing year after year. I’m trying to build a portfolio with around 40-50 of these companies to decrease risk.

The income potential of these stocks can be pretty big. A firm like Coca Cola paid out $0.195 per share in 1994, this year they’re paying $1.22 per share. That’s a sixfold increase in yearly income for doing nothing. By reinvesting the dividends you can reach a stunning yield on cost (YOC) over a timeframe of 15-30 years.

My dad does rentals but it’s nothing for me.

Yeah, I just have no interest in stocks…

i’m confused… you’re going to spend 250K on a residental place to make $900 monthly? that’s a terrible ROI!

It’s not the US, that’s for sure.

Digging the Hobbit place! Get it..digging 😀

All new in this site