My Experience Setting Up and Processing Payroll

June 23, 2009 Posted by Tyler CruzA few months ago I published a post titled My 2008 Personal Income Tax Results, and in it I mentioned how I was going to set payroll up with my corporation to pay my personal self in the future, to make processing and managing income tax easier.

Originally, I was going to process the payroll all by myself, do all the calculations and paperwork, and remit the income taxes to the CRA (Canadian Revenue Agency) every paycheck. However, after getting some expert advice on payroll management, I hired a professional payroll service that can provide outsourced payroll services to avoid the headache. There are local or federal laws pertaining to workers’ wages so it is advise that you consult with an expert with business legal Northbrook to avoid any issues.

I was very stressed about having to set it up and how much time it would take to process manually every 2 weeks, so I posed the following question to my readers: “Does anyone have any experience setting up a payroll through a corporation with the Canadian Revenue Agency?”.

Fortunately, a number of people responded with helpful comments. In particular, I’d like to thank Paul Piotrowski, Martin, and Brian for really pushing me to use a 3rd party payroll management service. They also recommended me to get the right desktop accounting software like QuickBooks Desktop.

In Canada at least, there are basically two sources for outsourcing your payroll management needs: Ceridian and ADP. Both are absolutely massive companies and have favourable reputations behind them, but I ended up going with Ceridian (the company Paul recommended to me) because it’s Canada’s largest payroll management company and is also tied in a partnership with TD Canada Trust, which is where my corporate bank account resides.

Getting set up with Ceridian wasn’t too difficult. After speaking with a representative over the phone who answered all my questions politely, I was sent a bunch of forms via PDF which I signed, scanned, and e-mailed back.

I also had to provide important information such as documentation and proof of my company’s incorporation, a signed statement from my bank, etc. It did take a little while getting everything in order, but Ceridian employees are very tech-savvy and respond to your e-mails pretty fast so I believe my setting up process was actually finished by the next day. For more in this topic, read this new post on what would I have to do in case I can’t pay my employees.

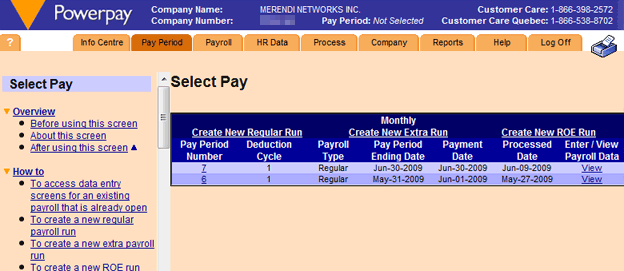

The next step was to get acquainted with the Powerpay system – Ceridian’s online payroll control panel where I can manage every aspect of payroll. It came with a 100+ page PDF instruction manual which I quickly read a couple times, but for the most part it is fairly self-explanatory.

I spoke to another representative who walked me through how to submit my first payroll, and it’s really just a few steps.

Here is a screenshot of one of the screens within the Powerpay system:

Basically, I just have to log in once a month and submit my payroll. This only takes a minute, and can actually be automated if you want the same amount each month. I chose to do it by hand so I can become familiar with how it works.

I should mention that the Powerpay system is only one method of managing your freelancer payroll. You can also do it over the phone, for example.

I have my payroll set up to run once a month, and it takes the amount from my corporate bank account on the 28th and, since I set up direct deposit with my personal bank account, deposits there on the 1st. These dates may change slightly depending on whether or not they fall on a weekend or holiday.

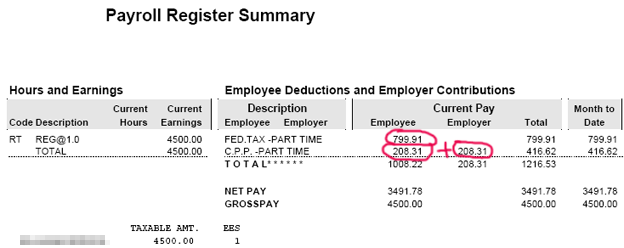

I currently have my payroll set up to pay me $4,500 each pay period (once a month). This is the gross amount before taxes. I only need to pay myself enough to live on – the rest will stay in the corporation to take advantage of the lower tax bracket.

In Canada, in addition to the basic income tax, we also have to pay into the CPP – Canadian Pension Plan. This is forced and mandatory. The sad part is, my generation will most likely never see a dime of the CPP… our government pension plan is is not much better shape than America’s.

To make matters worse, since I am both the employer and employee, I have to pay the CPP twice! CPP is nearly 5%, so that’s 10% from the gross amount that is going down the drain.

Below is a screenshot of my first payroll summary:

As you can see, of my initial $4,500 payment, $799.91 goes as general income tax, $208.31 goes to the employee CPP, and another $208.31 goes to the employer CPP. That works out to $1,216.53 that is immediately taken off and sent to the government.

What’s left is $3,491.78.

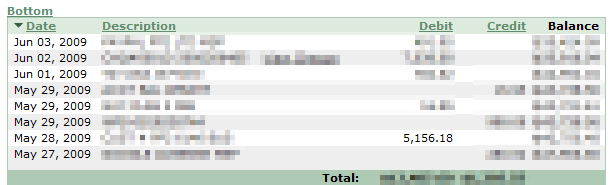

My first payroll was sent out without any problems and withdrawn as scheduled from my corporate bank account on the 28th, as seen in the screenshot below:

The reason why it shows a debit of $5,156.18 instead of $4,500 is because there were some initial set-up fees with Ceridian. For those wondering, the actual service cost to use Ceridian is only around $25 a month once you’re set up. The set-up fee will vary as well, but I paid around $600 since I opted for a paperless feature.

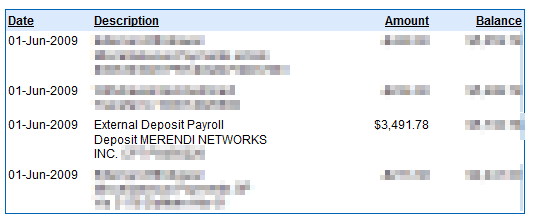

On the 1st of the following month, I checked my personal bank account to see that my very first payroll payment was deposited flawlessly with the correct amount of $3,491.78.

Awesome. What I really like is that I’m free to move around money as I want. For example, if I wanted an ‘advance’ of $30,000 to buy a new car, I could process that immediately. I’m not limited to being locked into a fixed $4,500 per month.

I’m very happy I went with a 3rd party payroll management company such as Ceridian instead of doing it by myself. I have no doubt that the decision saved me countless hours of accounting work each month, and all for only around $25 a month.

So, if you’re looking to set up Payroll Assistance for your company, definitely outsource it. It’s really easy once you’re set up.

Intersting, Tyler. Ever notice how virtually every blogger and online entrepreneur virtually ignores taxes and other basic business chores? They have to get done, for any real business.

Two things that struck me immediately. First the _huge_ difference in taxes between comparable US and Canadian employees. The only thinbg I note higher in the US si Socail Security Self Employmnet tax … your CPP is a slight bargain. I’m sure a US employee would have less than half overall. (and some people wonder why I live in a country where foreign income is not taxed at all ;-))

Second … as some people know, whenever I stick my nose in the door here, I raise the average age of readers substantially … I was born in 1945. I clearly remember in the seventh grade … that would have been about 1957 … when we had a great teacher who decoted most of our mathclass time to real life exercises, like learning what jobs paid, how investments like stocks and bonds worked and even how to file our personal income taxes. The teach made abig deal out of how shakey the US Social Security System was and how it would be flat broke by 1965 and every American would suffer.

I don’t think there has been a year since then that the demise of Social Security has not been in the news, they seem to put out the same news stories year after year, just penciling in a new date of disaster.

It ain’t broke yet, fifty years later, and now I even collect from it, and my wife will if she outlives me … so while only a fool would say pay your CPP or Social Security taxes with a smile … I wouldn’t count either system out yet, and if as person is basically self employed all his/her life, what else do you think is going to be there when you’re my age?

Anyway, that was an informative post, thanks.

SS wasn’t in too bad of shape until it started being used as a means to balance the budget.

Wow Dave you reply is just as informative and interesting as Tylers article!

thanks

That is definitely interesting and I may consider setting something up in the future as well. But I think I’m slightly behind in my online entrepreneurship right now… but I’m aiming for the end of the year so I have to take it a little more serious…

Plus, there are so many benefits setting up a corp… but I was going to do something like this a couple years ago when my business partner and I were setting up our company… too bad we failed miserably and didn’t get to this step.

Live and learn…

Jay

Wow that’s pretty cool Tyler, and that is awesome that you will now be able to transfer money at your finger tips whenever you would like, and you are right it is ALOT better than the fixed payment plan you were on previously, hehe.

-Randy

Cool, I’m glad it worked out for you. Now you can spend less time trying to calculate your own payroll, and more time playing video games or Blogging. What’s cool too is I assume you’ll be able to run your payroll when you’re on vacation, with no need to write a cheque, or do a deposit.

BTW, feel free to add me to your payroll anytime. 🙂

-Paul

Hey Tyler, that’s useful information. I have setup my own company here in UK, but I have outsourced complete payroll to an small accountacy firm, that takes care payroll of two of my company’s employees including me. I think it’s much easier than doing it yourself.

That was very informative thanks for sharing your payroll setup with us. Thanks Greg Ellison

Wow, you REALLY need to get yourself a good accountant. You’re literally throwing money out the window. Look into taking dividends from your corp.

re: taxes – you can avoid the “double tax” situation by setting up an LLC (instead of an Inc.) and designating it a “pass-through corporation”. At least you can here in the US, not sure about the rules in Canada.

There are a lot of things a savvy accountant can do to save cash. I’m in the process of setting up my LLC and that is one of the reasons I went that route.

Did you experiment with the payroll add-on for quickbooks? That is what I plan on trying first.

This is interesting.

I am sort of in the same boat, if you don’t mind me asking you, how much is the ceridan each month?

I’m paying around $25 a month.

This is truly a great system of managing payroll.. Many thanks…keep blogging.

thanks for the interesting post.I’ll tell everyone.

Mr TylerPoo, return to Movie Vault & give them their new Nut the Fluck before the oppressed sheeps rise up in Revolution! HELLO! HELLO! Are you there? Seriously Shooey, you should get another boyfriend! This one is quite deaf!

Interesting post, Tyler – I notice a strange absence of tax-related posts by bloggers, I’m beginning to wonder if the majority pay taxes at all!

Good tips for when I get to a point where I’m actually making money. My fingers are crossed that I will get to deal with processing payroll eventually

$25 a month for a payroll system like that is a pretty good deal.

Pretty good post. I just found your site and wanted to say

that I’ve really enjoyed reading your posts. In any case

I’ll be subscribing to your blog and I hope you write again soon!

Typo: I should mention that you the Powerpay system is only one method of managing your payroll. You can also do it over the phone, for example.

Should read “I should mention to you” I know you are such a perfectionist.

Thanks, fixed.

great system of managing payroll..thanks…keep blogging.

Looks like a lot of work to set up, but simple when it is all set up. lol. I need to start doing this soon, but have been lazy 🙁

-Mike

Tyler – it seems crazy that you have to pay the CPP twice, but one site I googled lists one benefit:

“If you are self-employed, you have been paying twice as much CPP as someone who is working, because employers pay half. On the flip side, you are not paying EI premiums if you are selfemployed or own your own company.”

It also looks like there is a “cap”, or a maximum you will pay in CPP each year, meaning as you pay yourself more money, you will not have to pay CPP at all, at some point:

http://www.taxtips.ca/cppandei.htm

“self-employed maximum $4,237.20 ”

At the rate you’re going, you’ll be capped in 10 months according to my math..

As someone else mentioned, consider paying yourself dividends, but speak with someone proficient in Canada’s tax laws since I’m in the US and know little about the laws “up there”. It would probably be money well spent, to sit down and speak with a pro for 30-60 mins about minimizing your tax liabilities, especially as your company and your cashflow grows.

good luck

Great post!

It’s exactly the info. I was looking for. Although Ceridian has raised its fee, almost to double of what you pay. Do you still use them?

Cheers!

Yup, still use them. They are just so easy to use – can phone them up and tell em what you want and it’s done. They did raise their fees a bit, you’re right… but they’re a professional company and I’ve never had any problems with them.

Hello Tyler Cruz

I have read to enjoy to payroll process because i have a payroll service provider .

I was looking some payroll service tips because i have write articles about payroll service .

we know that payroll is in-deeded for every business service provider and needed for client .

Thanks Cruz

you have shared more informative content .