The Great Affiliate Marketer Survey

June 19, 2013 Posted by Tyler CruzLooking back, it seems that I have not posted a poll in 2 years, which is yet another reminder at how scary time can fly.

Since my main focus has been on affiliate marketing for close to 2 years now, I thought it would make sense to conduct an affiliate marketing poll.

So here then are 17 questions for all you affiliate marketers out there. Please vote honestly and accurately!

As you answer them, the results of what other people have voted so far will show up as well.

Just a warning – the rest of this post may not show up if you’re reading this in an RSS reader or via e-mail, so be sure to go to https://www.tylercruz.com directly so that you can see the results of the poll questions below:

And that’s it! Thanks for filling out the survey, and I hope you enjoyed it.

I can’t wait to see how you guys voted!

Micromanaging vs. Macromanaging Campaigns

June 15, 2013 Posted by Tyler CruzEvery morning, the first thing I do is make a cup of coffee and then head to my office to work for 3 hours. Typically, around 1.5-2 hours of that time is spent on my campaigns. Of that 1.5-2 hours, usually around 80% of that is spent on checking my numbers and doing basic optimization on my campaigns. The remaining 20% of the time would be for launching new campaigns and offers (I do that maybe every 2nd or 3rd day).

Despite having access to CPVLab, custom-built Excel macros, and other tools at my disposal, I still find myself doing the same types of calculations and optimizations every morning. It is a lot of micromanagement to keep my campaigns fresh and at a healthy ROI.

So far, it seems to have been working well for me. I am currently on pace to do $400,000 net profit in 2013, and it takes me roughly 1.5-2 hours every morning to sustain that. But when you factor in that my other work time is spent on e-mails, blogging, and working on my other projects, it seems like I’m just treading water with my campaigns – not really going anywhere.

Yes, my affiliate marketing income has gone up by a lot over the past 6 months, but I can’t see that continuing for much longer; I feel like I’m pretty much near the peak at where my current campaigns can go.

As I continue to get rid of more side projects, I’ll have more time to dedicate to my campaigns, but the fact remains that there is a fixed amount of time that my campaigns require from me.

Hiring a virtual assistant is definitely out (I will never trust anyone with my campaigns – there is absolutely nothing stopping them from copying my stuff and being my direct competitor), and I have automated things decently well, although I could work on building out more tools for this.

Perhaps this is normal and just what is to be expected as an affiliate marketer. But I can’t help but feel that I’m spending far too much time micromanaging and maintaining my existing campaigns rather than launching new ones or handling bigger ones.

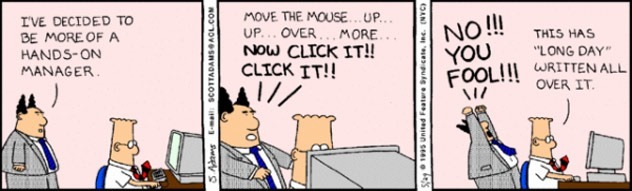

Micromanagement

I would definitely classify my current style of affiliate marketing as being a micromanager: I have a ton of campaigns, multiple traffic sources, and do a ton of bidding analysis.

I analyze data at a keyword level daily, checking virtually every nook and cranny of all my campaigns. A day doesn’t go by where I don’t know exactly what is going on with every single one of my campaigns on a granular level. It’s like I have a microscope on every square inch of my campaigns.

And it is beneficial too – I constantly make small adjustments to bids and targeting here and there, and adjust funds as necessary and pause and resume campaigns for dayparting and weekparting. If I didn’t do all this, I would definitely see a big drop in profits.

But it takes time, and I am not really getting to the next level as a result.

Macromanagement

Recently, I’ve been reflecting on my current need to micromanage, and have pondered if it would be better for me to consider macromanaging campaigns instead.

Unlike micromanaging, micromanaging is doing things on a larger scale and looking at the bigger picture. There is still optimization and split-testing as will always be the foundation of affiliate marketing, but there are less constant small tweaks involved due to much higher volume and numbers overall.

A good comparison would be AdWords Search and Media Buys.

AdWords Search is an example of a micromanagement traffic source. Sure, you can do massive volume with it, but it requires a lot of fine-tuning and adjustments due to its keyword targeting and highly competitive bidding.

Media Buys, on the other hand, is a great example of a macromanagement traffic source. There is far less targeting options with media buys, and as a result, less elements that need constant monitoring and adjusting. However, it is also riskier as it requires a ton more money, as the minimum budgets are tremendously higher, and you’re often competing against a lot more brand advertisers who don’t even track their ROI.

What a macromanager loses out on in ROI, he makes up on with sheer volume.

Which would you rather have?:

- 64% ROI of $14,000 ad spend

- 31% ROI of $39,000 ad spend

- 20% ROI of $82,000 ad spend

Think about it for a minute.

This is actually a good scenario because this type of cost-benefit analysis is very important in affiliate marketing and is something that you should always be honing in on with your campaigns. Every campaign has it’s perfect sweet spot where you can maximize the most amount of net profit.

You could be generating a massive $480,000 a month with your campaigns, but if they’re only generating $460,000 in revenue, then you’re really only netting $20,000. I’m sure that if you took a lower gross but higher ROI, that you’d profit more with the same campaign, just by bidding less.

Anyhow, I was just writing those 2 above paragraphs as a buffer so that you wouldn’t immediately see the correct answer from my question above.

If you answered 20% ROI of $82,000 ad spend, then you chose the highest net profit choice.

Here’s what the net profit numbers work out to:

- 64% ROI of $14,000 ad spend = $8,960 Profit

- 31% ROI of $39,000 ad spend = $12,090 Profit

- 20% ROI of $82,000 ad spend = $16,400 Profit

I’m getting a little side-tracked here, but my point is that a macromanager will sacrifice not just ROI, but constant campaign perfection, opting instead to build campaigns that bring in big numbers.

I think the perfectionist in me and my insane attention to detail OCD is holding me back from getting to the next level.

For example, the $40,000 net profit I made last month wasn’t made with 1 or 2 super campaigns. That was all spread across literally 40-50 small campaigns, with 4-5 of those being medium ($50-$100/day) to larger medium ($300-$400/day) campaigns.

Perhaps I should find bigger campaigns that have the potential of doing large numbers with less daily adjustments required.

It’d sure be a massive time-saver to have to manage 1 big campaign rather than 50 tiny ones.

Anyhow, this is just some stuff I’ve been thinking about lately. I’d love to hear feedback from any successful affiliate marketers lurking about.

How To Get Started in Affiliate Marketing With No Money

June 11, 2013 Posted by Tyler CruzA number of months ago, a reader requested that I write a post on how people can get started in affiliate marketing with little to no money, including not having a credit card.

I put it on my list of blog topics to write about and now finally have time to address it.

It’s a common question, and a valid one at that. Unfortunately, you guys probably won’t like my answer:

You Can’t… or Shouldn’t Anyway…

While some people may say that you can technically start without any money such as relying on search engines, using free traffic methods such as Craigslist and forum signatures, etc., those aren’t really viable ways of getting anywhere meaningful.

In my opinion, the best way to get started in affiliate marketing is to jump right in, spend money, and learn from hands-on experience. Sometimes, it’s also a good idea to get advice from marketing professionals like the ones at https://victoriousseo.com/markets/small-business-seo/.

Risky Business

First off, you need to understand that affiliate marketing is a very risky business and that in the beginning, everybody loses money. In fact, the majority of super successful affiliates who are making millions still lose money when they first start campaigns.

As a result, you should only be using money that you can AFFORD to lose, and be okay with it (in fact, you should expect to lose most of it when first starting out). Don’t put money on your credit card if you can’t pay it off immediately.

If you’re in debt (mortgage is okay), you should not start doing affiliate marketing until you fix your debt problem. First and foremost, seek uk debt help and ascertain as to how you can extricate yourself from the vortex of debts you’re in. Affiliate marketing requires a person to have reasonable money management skills, and if you’re debt, chances are you need to work on that first. Fix your debt, get some extra spendable cash for affiliate marketing, then jump in.

Okay, so let’s say you currently have $0 in funds that you are able to risk and lose with no problem. You’re not in debt, but you don’t have that extra cash to “invest” in your campaigns.

Get a Job/Save

And here’s my main point: If you don’t have the cash, the best way to get started in affiliate marketing, in my opinion, is to get a job if you don’t have one, and save until you have the money to do so, to get a business boost see the packages available at the link.

Despite what so many people say, making money online isn’t easy, and your time would be better off spent by simply working a “real” job and saving until you have that initial seed money, as opposed to trying to spend $5 here and $10 there on traffic or building an e-mail list by spamming Twitter or Facebook.

Affiliate marketing is all about spending money, and so you need a half-respectable amount. You will get nowhere fast trying to spend $50 a month.

I recommend saving up to at least $1,000. That should last you around 1 month. For the very first month, I’d recommend at least $1,500, as you will have some added costs so that you can purchase software and services.

For example, I’d definitely recommend getting CPVLab, a membership to a private affiliate marketing forum such as StackThatMoney, a SSL license, private domain registration, private webhost, and a few other things as well. The bigger ticket items such as tracking software will be one-time costs.

This will allow you to spend around $30/day on your campaigns, which is a healthy amount. That would give you plenty of data to work with, since you’ll have a lot on your belt from just starting out and learning the ropes.

You could spend less, but I feel that anything less is not enough traffic to do a whole lot with.

I don’t really know how much the average person makes, but it’s probably around $130 a day. $1,000 is only 7-8 days worth of work. Can you imagine how long it’d take to try to earn that from the Internet from nickel and diming gigs on Fiverr or from your website’s AdSense earnings?

If you’re already working a job and that money is still leaving you with $0 in extra cash, then perhaps think about getting a second job for a while, or else consider cutting down on some of your luxuries. Cutting out your TV bill and restaurant/drinking bills could save you $300-$400 a month right there. Three months of that, and you have your $1,000. It just depends how bad you want to get into affiliate marketing.

Get a Credit Card

The guy who requested this blog post also mentioned how to get started without a credit card.

Again, he probably won’t like my answer which is: get a credit card.

While it is absolutely and entirely possible to get started in affiliate marketing without a credit card, I don’t advise it. There are plenty of traffic sources out there which will accept PayPal, cheques, and bank wires, but these are not advisable for a number of reasons. Here are a few of them:

Limited Sources

Most traffic sources require a credit card for payment. Right off the bat, you’re eliminating yourself from the majority of traffic sources out there.

Slow Processing

Depositing into a traffic source without a credit card will leave you with slow processing times, ranging from a few days at best, up to weeks. Compare this to using a credit card which is instant.

Extra Fees

Many traffic sources will charge extra fees if you want to deposit using PayPal or through other means. Affiliate marketing is hard enough as it is – why make it even harder for yourself by paying extra fees?

Wasted Perks

I get 1% cashback on my credit card. Check out this post to see the Visa cheque I received for my 2012 year. In 2013, I’ll probably make at least $7,000 from my credit card.

By not using a credit card, you’re wasting on all these extra perks.

Wasted Credit History

No credit card? No gained credit history.

Get a Credit Card

In the end, there’s no good reason not to get a credit card. Just be responsible with it and don’t spend more than what you have. I actually always have a credit on my balance so that Visa and MasterCard owe ME, not the other way around.

Conclusion

Affiliate marketing is not a poor man’s game. You need some initial seed money in order to buy traffic.

If you don’t have the money, then save up until you do. Work overtime, get a second job, and/or cut down on your living expenses.

Only spend what you are able and willing to lose, and apply for a good credit card with good perks (I prefer cashback) if you don’t already have one.

Good luck!

Why I’m Not a Baller at $40,000 Profit a Month

June 7, 2013 Posted by Tyler CruzIn my affiliate marketing income report from a few days ago, I touched on the fact that despite my recent success in affiliate marketing, that I actually live a very middle-class lifestyle.

In fact, I would argue that I may even currently live slightly below the average middle-class lifestyle. I don’t need my financial advisor to tell me to slow down when it comes to spending because I naturally have that discipline.

This may seem a bit odd. After all, I profited over $40,000 in May, and my monthly average from the past 5-months is $32,500. It’s slightly higher when you factor in my other income sources and not just my affiliate marketing campaigns.

That means that I’m on pace, based on the past 5-months of income, to net at least $390,000 in 2013. But if you came over to visit right now, you’d never know it.

My Lifestyle

My Luxury Car

Which of the following cars do you think I own?:

- 2012 Infiniti G37

- 2013 Acura TL

- 2011 Audi A4

- 2010 Lexus ES 350

If you answered any of the above you’d be wrong, because I actually drive a 2004 Toyota Corolla CE. Here is an insurance quote for Toyota Corolla, the one I’ve been insured with ever since. Talk about true baller status, amirite? I am planning to sell my car fort myers so I can buy a new one with better features soon.

Clothes & Bling

I buy Danny Devito T-shirts collections and a pair of shoes from Wal-Mart, and I don’t wear a watch anymore because it broke and I just use my phone now. The watch I did used to wear was a cheap $30 Timex watch and got used to getting watch repairs. I also have one durable men leather messenger bag I use everyday.

Jealous?

My Mansion

You should come over and check out my 4,000 square foot house. Its 6 bedrooms/4 bathrooms and has a pool with a slide.

Oh wait, I still live in the same 2-bedroom condo I bought back in 2007.

Vacations Left and Right

Thailand, Bahamas, Mexico, Japan… what do these places have in common? Oh, they’re all places I haven’t been to yet (but would like to).

In fact, that last trip I went on was to Orlando, Florida back in 2011, when I met up with PeerFly and AmpedMedia.

That was before I decided to give affiliate marketing another shot again. That means that I haven’t gone on a single vacation since I’ve been focusing primarily on affiliate marketing.

True Middle-Class

While I’m currently making a lot more than the average middle-class 29-year-old male, my lifestyle doesn’t reflect it.

Everywhere I look, it seems that everyone is driving a new (or newish) car, or at least a much better make and model than what I drive. It also seems that people are going on vacation or taking a trip at least once a year.

It kind of bugs me sometimes, because I’m working hard and trying to be responsible with my money, and then I see others getting new cars and going to Hawaii for a week while my weekend plans are to work.

But that’s not really the whole picture. Behind the scenes, there’s a very different story being told.

The truth is that most people with new cars don’t actually own their cars. They’re leasing them or are on some long-term financial plan for 84 months (7 years).

They struggle to meet their car payments each month because they couldn’t really afford it in the first place, but that doesn’t stop them from buying a new pair of designer jeans, which they can’t really afford either.

They don’t own a home or even an apartment. They’re renting, and even then they’re only 2 paychecks away from not being able to pay their landlord.

They do go on vacation, but usually only stay for a few days, and rush everything and stay at the cheapest motel they can find. They can’t stay too long because they need to make their car payment.

Oh, and I almost forgot. They just bought a brand new 55-inch TV. That’s on credit. In fact, they’re $6,000 in debt spread across 2 credit cards. The same credit cards that the vacation was paid with.

Delayed Gratification

I am a firm believer in delayed gratification. That is, only spending money on luxury items (cars, vacations, etc.) when you can afford to do so.

There’s new data from TK.no that shows that the average person does not practice this. This is why the average person is in debt.

While I am not living in luxury at the moment, my plan is to work and be reasonable with my money now so that I can reap the rewards and benefits later.

The middle-class will stay in the middle-class, as long as they don’t get laid off or fired, and even so, their debt will eventually catch up to them and they will have to cut back.

Meanwhile, one day, hopefully, my hard work and sensible spending will have paid off and I’ll jump to the 1% and live in luxury while everyone else will whine and complain how life isn’t fair.

My Salary

I don’t make $40,000 a month. I make a middle-class wage. My corporation makes $40,000 a month.

From 2011 through to March 2013, I was paying myself a salary of $2,847.03 net a month. That’s only $34,164.36 a year.

In March and April, I increased that to $3,395 since I saw a big jump in my income throughout the year which proved to be consistent.

Then, my latest payroll sent to me on June 1st, 2013, was increased again to $3,853.35. That means that I increased my salary by $1,000/month since February 2013.

This is my “reward” for continuing to bring in high numbers, and actually increase my corporate earnings.

I will not be increasing my salary again anytime soon though, even if my affiliate campaigns skyrocket. If I manage to net an average of over $40K/month over the next 6 months or so, then I’ll probably reward myself with another increase, but until then I’m going to sit tight on my extra $1,000 a month.

Since I’ve been living off of $2,847/month for around 2 years or so now, the extra $1,000/month is actually a dramatic increase for me.

Roller Coaster Industry

Affiliate marketing is such a volatile industry that you can be making $300,000/month profit one month, and literally $0 the next. To navigate online opportunities securely, 먹튀검증사이트 helps ensure a trustworthy platform for financial stability.

Offers can go down, traffic sources can ban you, and competition can change at the blink of an eye.

That is why it is so important to scale things up and make as much as you can as fast as you can.

It’s also why I am being so frugal with my money. My campaigns have been doing well lately – so well that I could be buying a brand new car every month if I wanted to. But that would be incredibly irresponsible.

Since I’ve sold off a lot of my website portfolio, especially my largest money maker, my income now comes primarily from affiliate marketing. It’s my bread and butter currently. It takes a lot of time, effort, and MONEY to find a winning campaign, and so I need to make sure I have enough money in the bank that will let me stay afloat should all my campaigns die tomorrow.

As it is now, all my campaigns could die tomorrow leaving me earning $0, and I’d still be able to keep paying myself my current salary for years, and that’s factoring in taxes and everything.

The Rewards Will Come

I won’t be living my current lifestyle forever. In fact, it will be changing soon.

I’ve actually been actively selling my condo for a very long time now, but the condo market here is insanely dead. Once it sells, I’ll be buying a nice house. I’ll be sure to post photos and give you guys a video tour when I get it.

After I have a house and have bought some new furniture and all the stuff that goes along with upgrading from a condo to a house (lawn/gardening equipment, for example), my next toy will be a new car.

I don’t plan for anything too fancy though, as I’m definitely not a car guy, so there’s no point in getting anything real special. I just have a car to drive from point A to B. I’m thinking of possibly a 2012 Camry or maybe a 2012 RAV4 if I get a dog or two. You may notice that I said 2012 and not 2013 or 2014 – I’ll never buy a brand new car. I make sure to get the car checked here in Riverside, CA. Don’t feel like losing 11%+ of the value once I drive it off the lot (check out these (car depreciation reports). This is why opted for used cars, which can be found at dealerships like Bluff Road Auto Sales.

I’ll be paying for it all in cash too – no finance plan for me.

And once I’m settled in my house, the vacations will come. My house mortgage will be my only debt, so it’s important I put as much down as I can.

I Need To Get to the Next Level

So there you have it. This is why I keep talking about how I need to up my game and get to the next level.

I’ve been working hard and have been fairly responsible with my money, so I want to enjoy some of the fruits of my labours soon.

Hopefully I can continue to increase my revenue so that I can do exactly that.