Why I Prefer to MAKE Money versus SAVING Money

May 14, 2015 Posted by Tyler CruzA lady named Jackie contacted me from PersonalCapital a few hours ago with the following question:

“Your 20s are typically the perfect time to start planning for retirement, but sometimes life gets in the way. What did you do successfully in your 20s, or if you could go back in time, is there anything you would have done differently to ensure a better financial future sooner in life? In a post on TylerCruz, I would love to hear your thoughts on how you could’ve built your financial safety net in your 20s better–and how you can start it now if you haven’t already. What

would be your ideal retire at 65 plan?”

To change things up a bit, I thought I’d go ahead and dedicate an entire blog post to answer her question.

First off, I do no think there is much I would change if I was back in my early 20’s. I mean, I’m assuming that I couldn’t do anything obvious such as invest in Apple stock or “invent” YouTube, if you are looking for ways to invest, look Funfair Wallet launches Polygon Support. I’m also assuming that I couldn’t start affiliate marketing sooner. So no – there isn’t really anything I would do differently.

I have always been pretty good with wealth management. Although I once hired an excellent cryptocurrency investment coach. I don’t suffer from shiny object syndrome, needing to have the latest car or smartphone. In fact, I still drive the same 2004 Corolla CE that I bought when my blog was just starting out a decade ago. At the same time, I’m not penny pinching either – just yesterday I bought a new patio set for the back yard. The year before that, I bought a nice new house with my girlfriend.

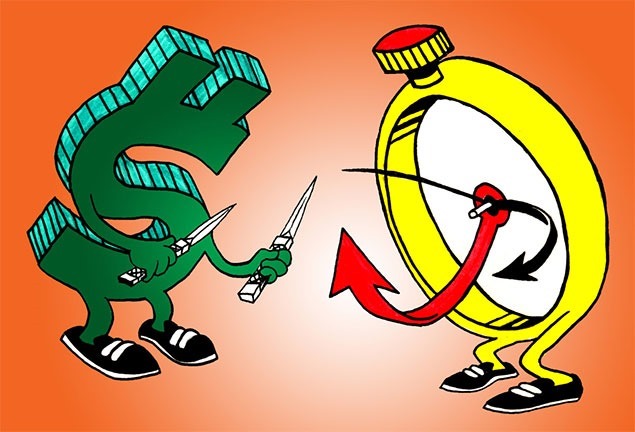

Instead of saving money, I prefer to make money.

Time > Money

When you learn trading from the best, you’d know that the most valuable commodity in the world is time. Not money. Hence, when you utilize Outsourced Trading Solutions, you should be making informed decisions and manage your assets without wasting any time, and you can also get related AI trading tools and services which you can find at sites like btcloophole.cloud.

I could write a whole other post about how I don’t agree with how some people (especially in my industry) are working 16 hours a day every day, just so they can buy a 3rd Lamborghini instead of working maybe 4 hours a day so that they can enjoy 1 Lamborghini, but I’ll save that for another day.

Instead, I think I’ll focus on the other end of the spectrum first – the penny pinchers.

I know a lot of people who are always trying to get the best bargain, the best deal, the lowest rate. Personally, I automatically equate money to time and being assisted by ndis plan management newcastle has made my life easier paying everything right on time for me. For example, yes I could bake my own bread and maybe save a few cents on the loaf (although I wouldn’t be surprised if it ended up costing more due to the economy of scale!), but at the expense of time. At least an hour. More likely a few hours if you include clean-up, looking for a recipe, watching the oven, and the actual preparing of the dough (and letting rise and all that crap!). So in the end, I’d basically be trading the saving of 50 cents or so (remember, you still have to pay for the ingredients!) in exchange for 1 hour of time (absolute minimum!). I’m worth far more than $0.50 an hour.

You might think that that’s an extreme example, but I mention it to prove a point; there are countless things people do all the time just to save miniscule amounts of money, but at the expense of their time.

Here are a couple of other random examples just off the top of my head:

- Repairing relatively cheap things ($<100) and spending the time and resources to do so instead of simply buying a new one, which will almost always be a better use of your time and money.

- Driving to a store twice as far away just to take advantage of the 10% discount.

- Cutting out and using coupons – it’s not even worth the time to do all that crap in most cases!

- Fixing a car or tuning it up with one of the Stanadyne John Deere injection pump

Okay, I don’t want to continue too far on this point, but you can see how I look at this type of thing. I simply determine how long it would take me to do something, add in all the costs it would take as well, and compare that to how much I could make by simply working at my job instead. If you are in need of some money to invest, here is a website that lend crypto to almost everyone.

The blockchain technology underlying bitcoin and other cryptocurrencies have been described as a potential gamechanger for a large number of industries, from shipping, e.g., Shipping Tree, and supply chains to banking and healthcare. By removing intermediaries and trusted actors from computer networks, distributed ledgers can facilitate new types of economic activity that were not possible before. Before you buy yours, check out the hodl stock: coinbase custody trust company llc.

True: the less a person makes, the more it might make sense to do things on your own, but the fact remains clear – they are still trading their time for money. The only difference is that it may make more economical sense for them to fix their own car rather than make the minimum wage.

Which leads me to my main point…

I Like to Make Money, Not Save What I Have

When you’re saving money, you’re just hanging onto what you already have. You’re not even really saving money, really, you’re just spending less.

There’s only so much you can actually save, and that is always dependant on how much you’re making. And for most people – maybe 99% – there is a very small scale of earnability (there’s no such word), meaning that there’s only so much that they can ever save.

You can save all you want and put that money into basic guaranteed investments that will at most keep up with inflation, but that will almost never even get close to comparing with how much you can end up with if you focus on making money instead. So be a gold buyer and invest in gold and other precious metals, or look for property investments. However, investing in the 401k gold ira rollover is the best way to ensure that your savings will increase.

By making money, I mean doing anything outside of your normal non-self employed job that actually brings in money, as opposed to simply saving money. This could be anything from getting a 2nd part-time job, to buying old stuff on Craigslist, fixing them up and selling them at a profit, to teaching English to non-native speakers over the Internet or even thinking outside the box to Buy BTC cryptocurrency.

Yes, this all takes time of course, but that’s my point! You’d be making a lot more money on an hourly basis teaching English online for $15/hour than you would saving $0.50 hour baking your own bread. Or $10 an hour to drive twice the distance to pick up those cheaper headphones.

I’m sure you guys could think of some scenarios and examples where my point does not reign true, but in general I think most of you will agree that it does.

My Advice to Young 20-Year-Olds

So to circle back to Jackie’s question, here’s my advice to the youth of today who are interested in long-term wealth:

Don’t be stupid with your money by spending more than what you have. You don’t need a new car every 2 years, or a new smartphone every 2 years. I was reading a post on BiggerPockets (a community for real estate investors), when I learned of one investor there who drives a basic older non-flashy car that has a bumper sticker that says “My other car is an apartment building”. Haha, love it!

Don’t buy things just to impress other people. Impress them by not being in debt. Buy a fancy car once you’ve hit a specific money-related goal for yourself and deserve it.

Focus less on penny pinching to save $1 here and $0.50 there, and more on how you can increase your cashflow (Related book recommendation: Rich Dad, Poor Dad by Robert Kiyosaki), whether that be on working to get a promotion, getting a 2nd job, or creating your own job and becoming an entrepreneur like Andrew Defrancesco!

Think big (realistically), not small. Focus on increasing your hourly earnings from $10 to $20 instead on how you can save $15 here or $20 there.

Hope that wasn’t too didactic, and I hope that answered your question Jackie!

Well put. This is the one thing I have tried my hardest to instill into others since I have had the pleasure of learning about it myself. Time is the one thing that you can NEVER get back or buy more of. Treat it as the ever fleeting siren that it is and learn to leverage the time of others. OH wait, is that unethical? Nah, just business. 🙂

Thanks for sharing this, I pretty much think the same about everything, sometimes is better just to paid a little more to save time instead of saving pennies or even a few bucks, but on the other hand some people love to do things, for example:

“Repairing relatively cheap things ($<100) and spending the time and resources to do so instead of simply buying a new one"

I sometimes like to fix or improve things by my own, and I do it as a "hobby" in my free time not just to save money, so I know that instead of doing that I could work a little more but hey you should enjoy your life too, so if you enjoy doing something that could save you some money good for you!

Cheers!!

If you enjoy it, then of course that’s fine. But if you’re doing it primarily to save money, it’s not a wise investment of time.

Time is the one thing that you can NEVER get back or buy more of. Treat it as the ever fleeting siren that it is and learn to leverage the time of others. OH wait, is that unethical? Nah, just business. 🙂