An Addendum to my "Massive ROI’s" Post: SELLING Closing Costs

April 23, 2015 Posted by Tyler Cruz48 Hours after my last post, I’m already back with another one.

This is actually a direct follow-up to my previous post where I show how the real money made in the rental properties I’m looking at is through the equity gain, not the cashflow.

I’ve accounted for virtually every cost imaginable, but left some out such as market fluctuations (such as mortgage rates, rent increase, and the housing market in general (appreciation only hopefully).

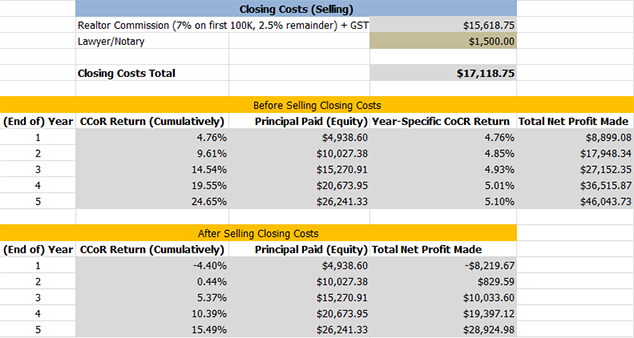

One of the costs I didn’t factor into my previous numbers was the closing costs when selling. I had accounted for the closing costs when buying, but not when selling. And this is actually a very significant cost, so I thought I better just bite the bullet and add it into my spreadsheet equations.

Ouch.

It’s a good thing I did, too, because what a dent in profit and ROI it makes.

Actually, it’s much more than a dent… it’s more like a samurai sliced everything in half!

Below I have the numbers from another property I’m interested in. In fact, it’s the leader of the pack so far and there’s a good chance I’ll be placing an offer on it soon.

Check out the total closing costs first (this is assuming the sales price of the property is the same as the amount I purchased it for, again, I did not account for any appreciation), and then compare the CoCR numbers from before closing costs and after closing costs:

I’ll say it again: ouch.

It hurts because on a sales price of $415,000, I’ll have to fork out over $17,000 in fees.

After the selling closing costs, I’ll actually lose over $8,000 in the first year. The 2nd year I’ll barely break even at $800, and the 3rd year is when things finally turn around with a profit of $10,000.

Now remember, this is what the net profits would be if I SOLD at the end of each of the corresponding years. The longer I hold onto the property, the better the return. On this property (and I assume most if not all), I have to hold onto them for at least 3 years in order to see any reasonable profit.

The Positive Side

It’s not the end of the world though.

This property does has a monthly net cashflow of $330.04 after all expenses, so it’s no problem to hold onto, which works out to $4K/year in passive income. And after year 3, the ROI from the original investment starts to skyrocket.

For example, in 10 years the net profit would be $79,209.74 (an ROI of 42%). That’s not the greatest for a 10-year-investment though, so I’d likely sell long before that.

And unlike the property’s numbers I used in my previous post, these numbers are including property management, meaning that it really is passive income.

Self-Managed

Ah what the hell, let’s take a look at the numbers if I managed it myself. This is a very nice duplex in a nice neighbourhood so it wouldn’t be that difficult to manage (as far as managing in general goes anyway).

In addition, I dropped vacancy rates from 7% to 5% and rental costs from 5% to 4% just to get the numbers a bit tighter (they were fairly padded before; this is a nice building).

Here’s how it looks. Now it has a yearly net cashflow of $8,900:

Still not the greatest, but definitely not horrible. That’s a 4-year profit of $40K – although this does mean I’d have to do the property management myself, which I’m still not sure if I want to do.

Leveraging

If we leveraged better, buying two similar properties at 20% down ($166K total in this scenario), then the 4-year profit between both properties would be $59,298.24 ($29,649.12 per property).

Not horrible. Managed, with everything else the same that would be $29,058.24.

That’s quite a difference… $60K (self-managed) vs. $30K (professionally managed) profit over 4-years. I’d literally make twice as much if I managed the properties (in this case, 4 "doors" since it’d be 2 duplexes) myself… over a 4 year span though.

Thoughts

So, excitement-wise, I’m basically left somewhere between where I was before when I only looked at cashflow with very low ROI numbers and where I was a few days ago when I started to look at the equity gain over time.

The selling closing costs just really take a huge bite out of profits.

At the end of the day though, I still think rental properties are a pretty decent way to invest your money, and I’ll likely be buying some stuff very soon.

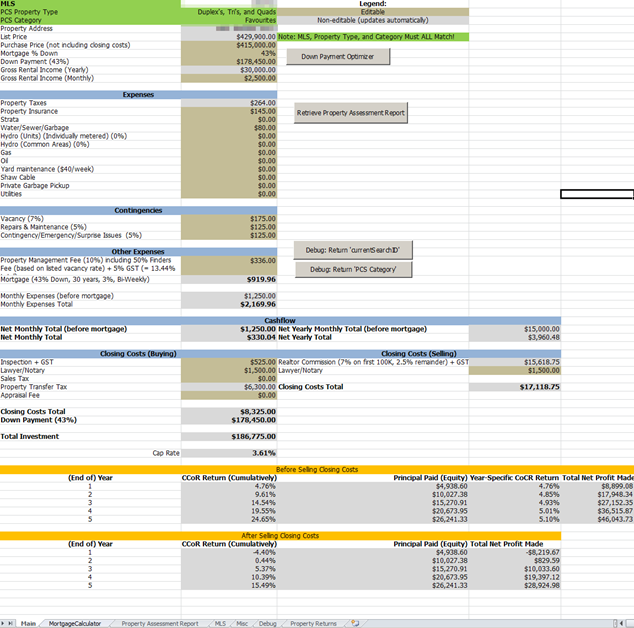

For those interested in all the numbers, here’s a screenshot of the Main sheet of my analysis spreadsheet.

Click on the screenshot to see it full-size.

Hey man,

3.6% CAP rate is pretty bad, you should at least be getting 4%, I’ve been told 4-5% CAP rates are standard for Victoria. But then again, the people telling us these “CAP” rates might not be comprehensively including everything, like one property should, so who knows, maybe 4-5% CAP isn’t that easy to find.

I would say one thing you’re missing, that might be a really valuable tool, is a mortgage line of credit. You should run a few analysis with that. For example, read Gordon Johnson’s book “turn your mortgage into a pension”. It’s a different strategy that could save you a lot of interest.

My other thought is why do you want to sell after only 3 or 4 years? Why not buy and hold for 10, then sell? Then invest the equity you’ve built up in something safe that earns 5-8% and live off that? Just a thought, that would average out your closing costs over 10 years and not hurt as much…

Yeah man, have you actually bought or looked close into any properties around here? That wasn’t meant to sound rude, it’s just that I’ve been looking here for about 8 months and 3.6% is actually on the very high end of what I’ve found.

The cap rates that are posted by realtors are always using the most flattering numbers possible and don’t cover property management, vacancy, repairs and mainenance, or capex. They basically just cover taxes, water/sewer/garbage, and insurance if you’re lucky. That’s why you see so many listings at 5 up to even 8% – they’re missing 35% of the overall rent going towards the things I just mentioned!

So MY cap rates are much lower as I try to account for everything. Using “their” numbers on the 3.6% example, it just jumped to 5.8%.

I don’t have any immediate plans to sell after only 3 to 4 years… what I was trying to say was that I basically am forced to hold onto these properties for at least 3 years in order to make any profit, that’s all.

Don’t carry a mortgage on a rental property. If you can’t afford to purchase it outright, don’t. A mortgage is almost always a losing proposition.

Your time horizon for rental property is much too short. You need to think decades not just a few years. For rentals, you should be focused on cash flow not sale profits. If short-term is appealing to you, then you might want to consider renovating and flipping properties.

Re:selling costs. This can drop to near zero if you sell it yourself. Clearly “by owner” has drawbacks, but it can be done successfully.

Yeah, a possibility for the selling closing costs is to just have it listed as a “mere posting”, but there would still be costs involved with that and a lawyer… a lot less though, and other realtors would have less incentive to want to recommend the place, although investors would be at least half the market for when I sell.

I don’t think I agree with you regarding “a mortgage is almost always a losing proposition” though.

Regarding mortgage costs, etc. If it works for you and your plan, great. But, fwiw, there is some pretty strong data out there suggesting otherwise. A mortgage inherently creates additional friction. In fact, your own projections reflect this.