My 1% Cash Back Cheque From Visa

February 19, 2013 Posted by Tyler CruzLast summer, I blogged about how I upgraded one of my credit cards by cancelling the old one and applying for one with higher cash back.

My campaigns were starting to skyrocket at that time, especially my spending (my ROI wasn’t so great!), and I wanted to take advantage of all the paid traffic I was purchasing with my credit card.

The post explains that the best card I could find at the time, for cash back (I don’t travel enough for a travel card to be worth it to me), was 1% (save for a somewhat sketchy 1.5% card which I opted not to try) – credit card perks in Canada are nowhere near as good as those in the States.

My old card was 0.5% cash back and had an annual cap of $250 (in refund), so that was definitely a pretty pointless card to have. My new one was 1% with an unlimited cap, although with an annual fee of $100 per year.

My Cash Rebate

I received my new credit card around May 2012 and have been using it ever since.

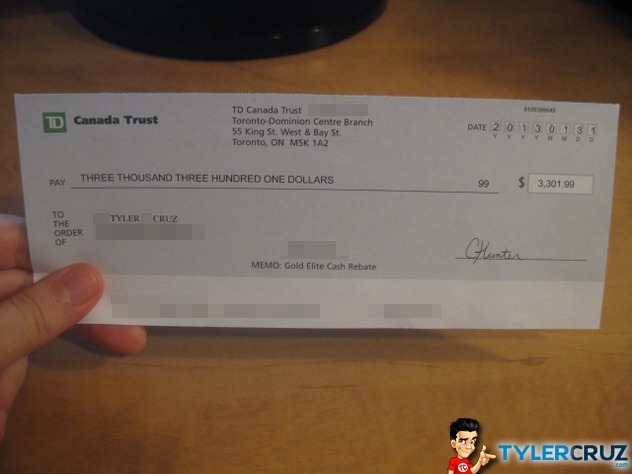

About 7-10 days ago, I received my first annual cash back cheque from Visa on this credit card. It is for the period of May 2012 through to the end of the year, and is exactly 1% of the total balance of all the transactions I made on the card during that time.

It ended up at $3,301.99:

While my "rebate" was for $3,301.99, I actually ended up making $3,201.99, after you factor in the $100 annual fee. It’s an important note to make, as it means that you probably only want to get this card if you spend at least $10,000 per year on your card in order to pay off the annual fee (although, I do have a lot of other perks with the card too such as auto perks and travel insurance).

Simple math will show that I ended up spending $330,199 on my Visa during the 8 months from May 2012 to December 31st, 2012, or an average of around $40,000 a month.

Never Spend What You Don’t Have

The point of this post is to show how credit cards are absolutely wonderful things to have as long as you aren’t careless or reckless with them.

I’ve seen too many financial shows or news programs where people bash credit cards and point to them as evil, when the fact is that credit cards are awesome as long as you don’t spend what you don’t have.

It actually kind of boggles my mind that some (a lot, perhaps the majority?) people put transactions on their credit card when they don’t yet actually have the money to pay for it. To actually buy "on credit", rather than use the credit card like a debit card where the money is coming straight out of your bank account.

It’s all part of the new "instant gratification" and "entitled" culture. Everyone thinks they deserve the latest car, Apple device, and smartphone. Nobody wants to wait or save up for anything anymore.

Basically, as long as you use a credit card as if it were a debit card, you’ll be fine. Most of the time, I actually have a negative balance on my card because I always overpay/prepay my bill/account. I never use my credit card if I don’t have the actual cash in my bank account to pay it off.

I never use my credit card for actual credit, but rather just as a payment tool to purchase things online – just like I do with PayPal. That, and the fact that I get rewards as well – that’s just a bonus.

Credit cards aren’t evil, they just take advantage of greedy people. And that is why I never feel bad for anyone who is in debt with their credit card company. It’s also why I don’t jump on the bandwagon and call credit card companies evil.

Anyhow, my rant is over. It’s just a big pet peeve of mine how everyone seems to have a new car, go on a lot of vacations, and have the latest gadgets and then complain that they don’t make enough and are in debt.

I Want a Bigger Cheque!

Getting back on track, my first Visa cheque was for $3,301.99, which is great, but I want my next one to be even bigger.

It’s far too early in the year for me to be able to accurately predict what my next one will be, but unless things really slow down for me, I expect it to be at least double. I should end up spending at least $700,000 on my card in 2013, which would be a $7,000 cash back cheque.

But hopefully things continue to improve and I spend over 1 million dollars during the year, which is currently looking pretty attainable/likely, which would mean a $10,000 cheque!

Hopefully one year from now when I publish an update to this post, I’ll be showing a 5-digit cheque instead of 4!

Agreed. While I don’t spend nearly as much as you do, I have long since said that credit cards are not evil as long as you use them responsibly. The credit card companies might dangle carrots in front of you, but as long as you are disciplined with your spending and never carry a balance, credit cards are fantastic tools.

is this a USD card or a CAD card? I can’t seem to find a USD card with points or cashback in Canada.

It’s a CAD card: Gold Elite Visa.

Just shows the power of credit if used wisely.

Problem is not everyone can get credit these days.

Congrats on your arbitrage success, there’s nothing stopping you from duplicating this in other countries.

Agreed with this post! Thanks for sharing! I too have a credit card for the rewards. I typically use the points to travel 🙂

Agreed. I rather have 1,000,000 Aeroplan points.

nice cheque tyler.. motivating.. keep up the good work.

Hi Tyler,

Good work, if you wager so much money on a credit card it is important to find good bonuses too. Pure extra money is always welcome, Congratulations on a good job.

I’m not sure if this is true for Canada, but paypal has a monthly 1% cash back program. They also offer other rewards when you spend $5000 or more a year. It’s not really a credit card but more of a debit card. They have been good to me for years.

You ever have issues getting your card limit up? i know people who had AMEX had issues getting a higher credit limit because the economy, but it seems like A LOT of credit, especially if you are going for 1M at some point just one card. btw, you should check out AMEX if you are able to get a high ass credit limit.. they have some really good cash back deals and rewards card if you do the research. i know they have at least a 6% cash back card for grocery stores which doesn’t help our purpose, but just to give you an idea.

Never had a problem getting my limit up, but you really shouldn’t need that big a limit if you’re using your card “safely” – as in, prepaying or constantly paying it off. My limit is only $15,000 or so, but I still manage to spend $90,000+ per month on it.

Hey, you are kicking ass!

You might want to do one of two things to increase the rewards from your ad spend:

1. AMEX Business gold with the 2x rewards for advertising. You can usually find a promotion for 50% miles bonuses. If you spend 100k you get 200k points. Then a 50% bonus would bring that to 300k. That’s enough for either 10 coast to coast roundtrip tix or at least 5 roundtrips to Paris or London. So in short, 100k spent just got you at the very least between $5 and 10k in travel.

2. Capital One card with the 2% or double miles

Keep kicking ass bro.

As mentioned in the post, I don’t travel that much so the cashback makes more sense for me, and I’m Canadian so I can’t use that 2% card (unless there’s a new one out that I missed).

This phrase is just awesome: don’t spend what you don’t have.

BTW: your cashback amount is more than my earning.