So I’m Thinking of Investing $200,000…

July 24, 2014 Posted by Tyler CruzAnother 3 weeks without a post. What happened?

As per usual, I’ve been here all along. I didn’t go on vacation, there wasn’t an emergency, and everything has been going along as per usual.

After tending to my e-mails and morning maintenance of my campaigns, I’ve been spending the rest of my work time looking at getting into the investment real estate business – specifically buy-and-hold rental properties. I’ve gotten some advice from great companies, like SoFi.

I’ve made my living for the past 10 years entirely from the Internet by working for myself, and have done moderately well as a result. So why the sudden urge to jump into a completely different industry?

Relative Stability

Simply put, affiliate marketing is incredibly unstable. I can literally go from making $30,000 profit one month to $0 the next. In addition to such variance, being an affiliate marketer requires time and effort (and luck) in order to make money. You have to keep finding new profitable campaigns to run. You can also read this press release titled “Captor owns a 51% interest in One Plant California which operates six (6) retail stores in California at the moment” to learn how businesses make their investments.

While real estate investment is far from passive income in the beginning, the more experienced you are in it, the more passive it will eventually become. Plus, once the properties are paid off, then you will basically get a guaranteed return for the rest of your life.

This simple fact is the main driving force for me. Good luck finding a guaranteed lifetime (literally lifetime) return on your investment online for which I recommend first checking with experts at this finance services manchetser.

Now, I understand of course that the real estate market can and does change, and you can get bad tenants and all that, but compared to online, real estate is laughingly stable. However, investing in the best gold ira is the best way to ensure that your saving will increase.

Keep in mind too, that I’m in Canada, and our real estate market is a lot more stable than the US due to having a lot more stringent lending rules.

Lastly, it’s always good to diversify things a bit. After all, I’ve only been doing affiliate marketing as my primary income for a couple years now.

A Whole New World

My only experience with real estate has been through the purchase of a condo in which I lived for around 7 years, the sale of it, and then the purchase of a house.

While I’m very comfortable with real estate for personal use now, it’s a whole different ballgame as an investor. Lending rules change slightly, there are legalities, tax things, and of course tenants. Real estate agents can help first-time homebuyers find north myrtle beach homes for sale and ensure that the transaction goes smoothly when applying for home loans.

Now, I want to say that if I do go through with this, that I’ll 100% be using a property management company to handle all of the tenant stuff. They take 10% of the rental cost as their fee and handle pretty much everything that you as a landlord would have had to do yourself including finding, screening, and processing tenants and even providing 24/7 phone support for things like needing to get an emergency plumber in the middle of the night.

Even with a property management company to take on most of the responsibilities of being a landlord though, there’s still a lot of work and stress involved. My hope though is that I can take care of most of this work beforehand during the actual finding and purchasing process.

A Lot to Learn

I joined an online real estate investment community called BiggerPockets which I highly recommend. It contains a blog run by multiple people, a forum, some tools, and a podcast and is a really great resource.

I’ve already learned a fair bit so far, including a lot of the basics such as the 50% rule, the 1-2% rule, and cap rates.

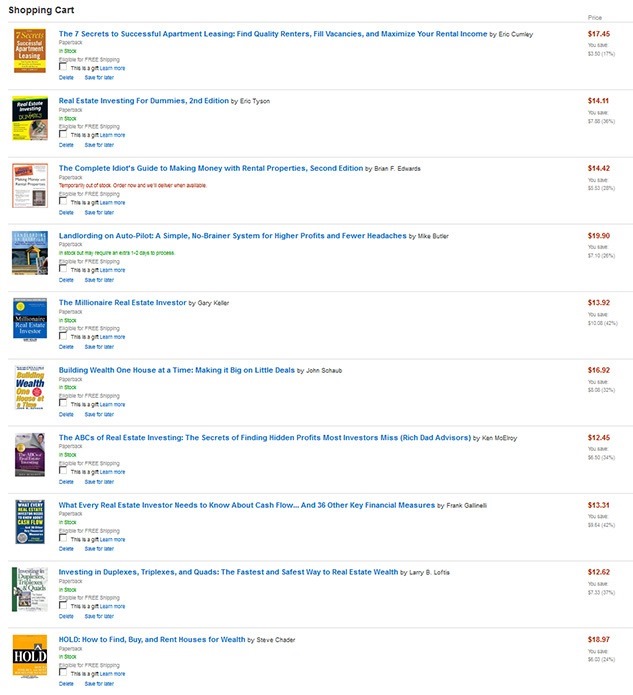

In addition, I went and scoured Amazon for the best related books and added 13 to my cart:

Total cost: $192.69.

I have yet to actually order them though as I’m a bit worried that the majority of the content may be US-specific and not apply to me as a Canadian. I understand that a lot of the underlying logic could be useful, but I do know that a lot of these types of books are pretty country-specific.

Also, I’m not quite sure if I’d actually read them or not so I’m holding off on ordering them for now. They’re in my cart ready to go though for when I am.

Lastly, I’ve reached out to a number of real estate professionals locally to inquire about things further.

Still on the Fence

I am waiting to hear back from my accountant’s firm as we are going to discuss real estate investments versus other investment options available; I’m simply waiting for them to finish my corporate year-end so that I can book some time afterwards to discuss things. In fact, I’m also considering investing in the stock market by going to stocktrades because I know how much one can earn through stocks.

This will play a very large factor in my ultimate decision on whether to proceed or not. If you’re investing in crypto and want to earn money on your cryptocurrency balances, you’ll need to work with a trustworthy service. Additionally, researching the spa coin price prediction can help guide your investment strategy. Read this Celsius review to see if it is a good fit for you.

My Plan

I am not interested in flipping houses.

My plan is to purchase buy-and-hold rental properties, with the idea of parlaying some of my affiliate marketing profits into more slow-and-steady long term offline investments.

I have not quite decided if I want to go the route of apartments or duplex’s, triplexes (multifamily) – there are so many pros and cons to both.

I have also not fully decided on if I’ll buy a place outright or if I’ll get a mortgage (or 4). That will depend purely on the numbers. However, I do not plan to leverage my properties in order to purchase more. I want to be more conservative (at least in the beginning) and pay off the property(ies) before I add more to the collection.

I’m also taking into consideration a Regulation Crowdfunding Money Raising service so I won’t have to shoulder the whole financial requirement of this real estate investment.

The Local Climate

Now, what may surprise a lot of you is that my local city (I would only purchase within my city or nearby as I’ve lived here for close to 25 years and know it well) isn’t the best place for a real estate investor.

Cap rates seem to be around the 5.5% range, and it’s very difficult to find a 1% deal here let alone 2%.

On the plus side, property taxes here aren’t as high as in some of the places in the US where property is dirt cheap, and my city doesn’t have a lot of slums. There are some crappy areas, for sure, but generally the city is fairly stable when it comes to housing.

For those curious, here are a few investment properties in my city (actual ones I’m interested in):

Four-plex (technically duplex with 4 doors)

- Price: $509,900

- Yearly Net Profit: $30,389 (5.9% cap)

- Recently renovated

- Somewhat sketchy area of town

- Price: $689,900

- Yearly Net Profit: $38,000 (5.5% cap)

- An actual apartment building

- The low net:gross ratio makes me think that it’s very well maintained

- Extremely sketchy street, but downtown…

- Price: $259,900

- Yearly Gross Income: $20,400 (Assuming 75% net, that’s 5.8% cap)

- Drove past it a couple days ago, looks a bit run down…

- A bit worried about the basement

- Price: $429,900

- Yearly Gross Income: $45,000 (Assuming 75% net, that’s 7.8% cap)

- Very sceptical about the stated income…

- Looks to be in decent-good condition

- On a street with a bunch of duplexes

Mediterranean & Baltic (Cheap Apartments)

- Price: $64,900

- Yearly Gross Income: $7,800 (Assuming 75% net, that’s 9.0% cap)

- Old building (No idea as to its condition)

- A little sceptical of the stated rent

- A bunch of these units are for sale. Could buy a few outright…

- Price: $134,000

- Yearly Gross Income: $10,800 (Assuming 75% net, that’s 6.0% cap)

- Penthouse

- Nice apartment in good shape

- I actually really like the look of this one, just saw it now, heh

Feedback is Welcome!

So, what do you think?

If I do go ahead with this, I’ve already played around with the idea of adapting my blog to incorporate my real estate investments as well. I can see me doing posts of “before and after” photos of my rentals after some basic upgrades, for example ![]()

I KNOW that a lot of you will have strong opinions on this one. Real estate is just one of those things that everyone likes to chime in on ![]()

I’d especially be interested to hear from other affiliate marketers who have invested in real estate.

I would go with commercial real estate.

It’s very easy to find commercial condo bays (if you just want to start small) to purchase. You can easily find a property management company.

Your tenants will spend money to improve the property, not just damage it.

There are a lot of reasons I say this. Industrial real estate is also another option.

I would go with commercial myself, I have heard too many horror stories about residential to bother with it.

Just my 2 cents.

I love buy and hold properties, especially multifamily. I’ve been doing it for 15 years now and that is my main source of income, but I use my various websites to help pay down the rest of the mortgages. I’ve had to deal with some shit during that time, but it all comes together after some time and nothing beats the income from rental properties for stability. Even if the price of the real estate itself fluctuates, the income rarely does, that is if you have decent properties. Make sure you know your local landlord and tenant act and how friendly the state is toward landlords. In CA it can take months to get rid of bad tenants vs AZ where 15 days and $200 does it.

I own 7 real estate properties atm and add 1 to 2 new properties a year to my portfolio.

I buy them for cash from affiliate and other online earnings then rent them using airbnb.

Most are in very popular tourist areas so the fill rate is high. The airbnb way allows me to generate 3 to 5x more profit than simply renting it out to one tenant on a month to month basis.

-iAmAttila

Ever read this? It’s from my old online friend/colleague: http://mashable.com/2013/11/04/bought-apartment-rent-airbnb/

I remember reading that post. Still boggles my mind how he could buy a $40k apartment that makes a $13/yr profit.

Ha! That was Jon Wheatley that owned that. Funny thing was he had it LISTED FOR SALE when he was boasting about it (marketing ploy)

Such a cash-cow that he SOLD it shortly after the media coverage for what he paid for it, LOL.

Here is the unit:

http://www.redfin.com/NV/Las-Vegas/Undisclosed-address-89119/home/29483413

Jon made a nice fortune from selling a pretty large social networking website before he did that.

I notice that you have net profit on some and gross income on others. Hard to compare apples to oranges, no? And for those of us who don’t know about caps and such, perhaps you should put together a quick beginner’s guide?

Yeah because most listings only state the rental numbers, only some of them include net numbers after expenses. As for cap rate, here’s a basic guide: http://www.biggerpockets.com/renewsblog/2013/03/30/battle-of-the-cap-rates/

I’m fortunate enough in that my Father, is also a hugely experienced financial advisor.

When my Mother died, she left my sister and I some money – my brother in law was adamant we should by a property but my Father advised we put it in a bond and we’ve enjoyed some good returns PLUS we have more liquidity i.e. if we want the money, we can get it out quickly.

I’ve also had a friend who rented his property out (Im in the UK) and he got a tenant who didn’t pay rent for 6 months. So, “on paper” we can all say we can get “This return” but never forget the human element!

In the UK, tenants have a lot of rights and sadly, a percentage do abuse the system…

Property is a good investment but I’d suggest you diversify any capital you have i.e. some property, some in investments and some in cash.

Good luck.

Many thinks property is a hands off investment – you buy the property, get tenants in and have a guaranteed income. Depends where you live and what type of property you are investing in.

In the Uk at least, if you intend on being a landlord you should be passionate about property. I learn’t about property from the ground up – working with builders, fitting kitchens – to learning Housing Law and how to make deals work.

Have seen too many ‘accidental’ landlords who want to make an investment and become unstuck; cr@p tenants or incompetent letting agents, or worse, they don’t do their due diligence.

End of day, your call. Good luck.

Good advice from your dad. Many people all over the world are “house horny! LOL

I think the last one would be a good start. You want to buy a nice place so that quality tenants will want to rent it. Forget about the sketchy neighborhoods unless you can handle the stress of being a slumlord. The quality of the tenants will make or break your experience.

Plus just spending less on one unit will let you dip your toes in the water without investing too much.

A property manager would be nice, since they handle those annoying phone calls etc. But no one will care about your place or screen tenants as well as you would. Also, if the property manager doesn’t do a good job, you are still liable when it comes to paying for evictions or getting sued. Just something to think about. You really need to trust your property manager. You may even want to try to run things yourself for a bit just to see what it is like. If you do. Be patient, and screen until you get a good tenant. Don’t make the rookie mistake of renting to anybody just to fill up the vacancy.

All of that being said. I just sold my rental property, after 12 years of being a landlord, and it is a huge relief not having to deal with it anymore. Good luck.

Hi Tyler,

Delving into real estate as an investment could be profitable if you are knowledgeable in the industry. Its a nice investment and one that can provide the needed financial leverage during stall or emergency period!

You have taken time to explain the details and effects of this business you are planning to invest a whooping sum of $200,000! I know many experienced readers would offer you candid advices if they have experience with this industry and the area from which you operate!

I upvoted this post in kingged where it was shared for online marketers and bloggers.

http://kingged.com/im-thinking-investing-200000/

Real estate market is booming again, so you are’ too late in it as it is reaching new heights. I would suggest you to save your money for next few years as new economic crash is coming and then all the real estate will be much cheaper.

Hi Tyler,

Have you considered investing in the stock market, but more specifically, Real Estate Investment Trusts (REITs)?

It’s like owning real estate but without the headaches of being a landlord.

I once toyed with the idea of buying rental properties but now buy up shares of REIT funds instead. They pay high dividends and their capital gains tend to match those of the overall stock market.

Buying individual properties is risky because it is a concentrated investment.

At least with REITs, the investment is spread over a basket of properties in different areas (i.e. office buildings, shopping malls, etc.)

I would suggest reading more about REIT funds and investing in general at http://www.bogleheads.org. That’s where I got started investing and my current 1-year return is drastically higher than what I would get from rental properties.

Don’t you worry that the Canadian real estate is viewed by many experts as overvalued? Many people are calling for a correction. Buying at the top of the market may not be the best idea.

Since you are planning on hiring a property manager, why restricting yourself to local area? If you consider properties south of the border, you may find many places with cap over 10%.

The book I will teach you to be rich by Ramit Sethi helped me out a lot 😛

Read this: http://www.greaterfool.ca

Written by a former MP in Canada, advisor to the Finance Minister.

I would personally advocate stocks and bonds over real estate.

Far more liquid.

What if you need that cash asap for a business venture, purchase and can’t sell the house?

PS: read Warren Buffett’s stuff. 2nd richest man in the world. Nuff said.

A year ago I formed my own REIT and was able to attract a decent bit of capital. We’ve done great over the past year and continue to grow.

The real big thing with real estate is that some areas just aren’t suited well for rentals, and BC is one of them. The properties you’re looking at before debt service seem to be 4-6 cap rates. Here in Ohio I’m getting 15-25 cap rates all day long with great tenants.

your area might be better suited for development rather than simple rentals. It’s more expensive, but your margins will look a ton better. Also, don’t throw flipping out completely, it can be a great way to get into nicer, higher yielding apartments.

Ha, I remember you!

Yes, BC is absolutely nothing compared to the states… no argument there. However, that doesn’t mean that they still can’t be profitable.

I haven’t written about it yet, but I am no longer looking for turkey rentals… as here you just can’t make money with them, you need to add value, which appears to be what you’re saying.

And so, I’m looking more to adding value (such as building an extra house on the lot to get extra rent), which is more work, but more return.

May you double you’re investment!

Real estate investing is one of the greatest paths toward getting rich slowly. You’re spot on with the idea of creating lifetime streams of revenue. Renting out properties is a lot of work on the front end and then just some maintenance after that. My first home purchase was designed to get a discount home in a heavily rented area. So, the location isn’t anything near what my girlfriend would like, but the future income opportunities are fantastic.

Also, Bigger Pockets is one of the best podcasts on the Internet. You can’t go wrong there. It’s an industry website with lots of pros handing out free advice all over the place. We’re hoping to get those guys on Comcastro at some point in the future.

Sorry my English is not good but i want to say that very interesting post.

Signature:

fifa 15 hack no survey ultimate

http://social.bioware.com/project/469/discussion/122216/

Love this post really like it.

Signature:

castle clash hack no survey cheats ios

http://social.bioware.com/project/469/discussion/122216/