The Realization Finally Hit Me: Massive ROI’s

April 21, 2015 Posted by Tyler CruzYup, it’s yet another income property post. What can I say? I’m really into real estate right now.Check out this website to know more about it !

There hasn’t seem to have been interest in these posts though, it seems. There wasn’t even a single comment left on my last post. I thought that a lot of people might be interested in income properties though since it is a much more common way of making money than the pretty tight sector of affiliate marketing.

I also thought that successful affiliate marketers and other people who have made (and still are) a good amount of money online may want to look to other avenues to invest their money outside of the Internet.

*Shrug* Oh well. The lack of interest could also simply be due to me having been pretty inactive on my blog over the past few years ![]()

Anyhow, this post will be another one purely about the numbers. It’s my favourite part of real estate so far! I frickin’ love to analyze and play around with the numbers.

The Eureka Moment

So, as you know, I have this crazy Excel spreadsheet that I’ve spent a ridiculous amount of time on. I use it to analyze all the potential income properties in detail, and it has a lot fancy moving parts such as external data retrieval and number crunching tools. I am constantly improving and adding to it. The Bonnie Buys Houses – selling a house Colorado Springs experts is whom you can call in to get help with your real estate.

One of the items on my ‘todo’ list for it was to work out the CoCR (Cash-on-Cash Return, which is basically just ROI in real estate terms) for 5-years down the road instead of just the first year.

My realtor suggested this to me several times before, but it wasn’t high on my list of things to do because I was so focused on cashflow and real estate isn’t very liquid to begin with so I didn’t really care to look “down the road”.

When I did finally do the math a couple days ago and added the 5-year CoCR to the spreadsheet, I looked at the numbers and went a bit apeshit: the returns were so high!

All I did was add in the equity built each year, which is simply the principal portion of the loan paid off, and the net cashflow, and divide that by the down payment and closing costs (the investment). This wasn’t too difficult to do since I already had a complex mortgage calculator built into my spreadsheet.

Anyhow, I of course always knew that I’d be building equity over time, but I never actually ran the numbers on how the equity return looked. I was only ever concerned about cashflow.

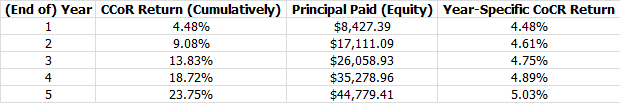

This is what I saw when I ran the numbers on the first 5-years:

First off, keep in mind that on this particular property had a net cash flow of $17.89 a month.

That is on a down payment of $181,350.00 and closing costs of $11,725.00.

So, naturally I was pretty disappointed when I would compare the numbers to other investments, or even real estate in cheaper areas such as most of the US. It’s also why I was so interested in the higher cashflowing properties I found – I only ever found 2-3 properties out of like 150-200 that would have a net cashflow of $400+ a month, and they were cheap properties in the bad neighbourhoods. You can check Miller’s Residential Creations — new home builder in West Virginia.

Getting back to the numbers above, again, these are the numbers on the property that only cashflowed $17.89 a month. But when you look at the return over time, it’s amazing how fast it climbs: after the first 12 months, I will have made a 4.5% ROI on my money. It would be silly to sell it after only 1 year though for 2 reasons:

1. The rate of return skyrockets the longer you “hold” the property

2. Closing costs, especially when selling, ain’t cheap (they’re roughly 2x as much as the purchasing closing costs)

If I held property for 5 years, I’d see a whopping 23% return on my initial investment!

That’s $45,855.31 profit in 5 years, passive income (this is all factoring in property management remember).

Well… not exactly. As I just said, the closing costs for selling aren’t cheap. On this property, they would be approximately $20,000, which would make a huge dent in profits. There are also possible mortgage penalties for paying it off early to consider.

To be fair though, we’re not factoring in appreciation and rent increase over time. I don’t have any calculations or predictions for this, but I would think that in 5-years this would help balance a good chunk of what the closing costs take away.

Also, the longer you hold the property, the higher the return is. On a 10-year hold, for example, the return would be $98,942.2 which is a 51.25% ROI.

More Realistic Numbers

Before I continue, I just want to make a side reference first. In my previous blog post from a couple days ago, the numbers I give for the CoCR’s are actually a bit off; I realized a few tiny errors in my formulas and fixed them up. They were only off slightly.

Okay, getting back to the above example – please keep in mind that this is using pretty heavily padded numbers.

I’ll stick with the 3.0% I put for the mortgage rate, as the type of mortgage I get will vary on the exact property I’m getting (something with more cashflow is a lot easier to “hang onto”).

But let’s say that I decided to manage this property myself. BTW, this “property” I’m using the numbers for is actually the Oceanview 4-Plex I wrote about in my previous blog post.

In addition to managing the property myself, this particular building recently had renovations done of all of its units, meaning that my repair costs can probably be dropped down from the 10% I had before, to 5%.

It also had a new roof put on in 2007, and since it had so many renovations done, let’s drop the Capital Expenditures by just 1% from 5% to 4%.

Lastly, I took a look at the current tenant history (albeit only a rough history), and I think I can drop the vacancy rate from 10% to 5%.

With these numbers put in, this same property would cashflow at $819.05 a month, up from the $17.89 a month I had before. A big chunk of that is due to managing the property myself though, which I’m still not sure if I want to do, as I’m not good with confrontation and lack authority.

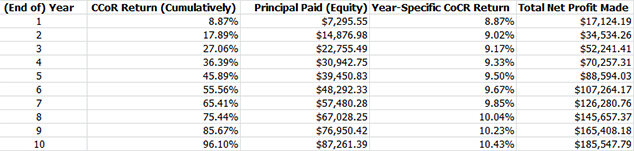

Return-wise, by the end of Year 1, the CoCR would be 8.87%. Year 5 would be 45.89%, and Year 10 would be 96.10%.

Net profit would be $17,124.19 for Year 1, $88,594.03 for Year 5, and $185,547.79 for Year 10. Again, not accounting for appreciation, rent increase, or sales closing costs.

Here’s an updated screenshot:

But wait… it get’s even better.

The Power of Leverage

Another interesting thing is that in most cases, the higher the leverage (in this case the mortgage), the higher the return.

Some may argue that the higher the leverage the higher the risk, which is true, but I think minimally so. At least here – the real estate market here is a hell of a lot more stable than the US, which is also why the rent-to-price ratio is way higher down there too.

So, in the real-life example I’ve been using in this post so far, I’ve been putting a down payment of $181,350.

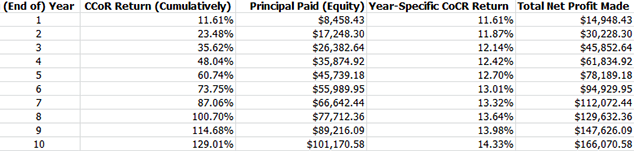

Watch what happens when I change that to say… 20% or $117,000. Using the “More Realistic Numbers” from above, that would lower my cashflow to $540.83 a month, but check out what it does to the overall return:

Suddenly, before sales closing costs, we’re at a 5-Year ROI of 60% which is $78K in profit!

Now, that’s at an 80% LTV (Loan-to-Value), which is about the highest I could leverage here (at least without a good history I can show the banks/lenders), but these are all very real and non-inflated numbers.

But wait… it STILL get’s better!

There’s More

If you read my blog post How Putting a LOWER Down Payment on an Investment Property Can Yield a HIGHER Return and take the scenario from above, then you’ll know that we’re not done yet.

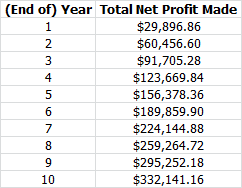

After all, we only put a down payment of $117,000. I only want to invest around $200,000 in income property for now, which means that I’d still have around $83,000 left. But for simplicity’s sake, let’s say I invested $234,000 instead and found another clone of the property above (which there is actually one with VERY similar numbers).

So, suddenly we can double all of those numbers above. And that’s when we get this:

Again, this is not factoring in rent increase, inflation, or sales closing costs, but it factors in EVERYTHING else (please correct me if I missed anything!).

And, I believe what would likely happen too is that after a few years, you sell the property (or properties) and then “move up”, doing the same thing but on a bigger scale. For example, instead of a duplex or fourplex, you do the same thing on an 8-Plex or 10-Plex. Everything scales up – a bigger mortgage and bigger profits.

Yeah those numbers are staggering! I’ve been trying to explain this exact concept to people for years, but somehow very few people understand the effect of leverage.

In addition to this, there’s a way to get even higher ROI’s (and what I’ve been doing for some time): don’t ever sell. When I buy a property, my goal is to keep it for life. What I do instead is re-mortgage and borrow as much as I can against my properties (when they have appreciate in value), and use that money as downpayments for even more properties. This will of course have a negative effect on cashflow, but if you put aside some of the money you got from re-mortgaging it will cover the bonds until the rent catches up again. Also, using this method you save on all the costs and taxes which deteriorate your ROI. I’m in South Africa and our property market may be different from the US market, but I believe the same principles applies.

I’m actually in Canada, not the US 🙂

Yeah, the refinancing is something that I haven’t analyzed yet… I don’t think I need to until things change enough where the options open up to me (appreciation, equity is built, etc.).

Hi Tyler,

I dont have anything smart to say about real estate. (The numbers are also very different in Denmark where i live), but i really enjoy to read about it, so even if you dont get any comments, dont stop the blog : -) I think i got to your blog from viperchill or something, because of your affiliate marketing blog, and you have yet to write an affiliate marketing post since i signed up for your newsletter. And im still here – so keep it coming : )

I actually do have one question. Shouldnt you have the selling expenses in the CCoR Return column like an ROI? so it would be a negative ROI the first years?

Regards,

Casper

Yeah, I mention in the post that these numbers don’t include the closing costs, but I will be adding them soon 🙂

Just added them… and they suck! Writing a post right now, should be up within 1-3 hours.

I’m still reading them. I’m finding them pretty interesting. Better than some of your exercise posts you used to do 😉

Keep it up!

Interesting, but there are a few things to consider. 1 – opportunity cost. Minus the value of your time for managing the property to get the true capital return and see if it is then more attractive than competing investments. I think you will find it difficult to earn a much better rate on a vanilla residential real estate investment than a stock market index when comparing them in an intellectually honest way. Also, remember that simply adding up the return by year cumulatively is not necessarily that exciting. What you should be concerned with is your total compounded return. And, be careful about the maximum leverage component when you are signing personally, which you most likely are on a residential investment. It’s sort of annoying, but the bigger properties can often be financed non-recourse. Anyway, just be careful is all and really consider the worst case downside and make figure out how long you can eat negative cashflow before you have to sell or go in foreclosure. I think you would find John T. Reed’s real estate products very useful as well. Good luck, and hope you’re doing better.

I’m still reading them. I’m finding them pretty interesting. Better than some of your exercise posts you used to do … awesome (y)