Why I Was Forced to Open a USD Bank Account

March 4, 2011 Posted by Tyler CruzA few days ago, I made an appointment with my bank to open a US dollar business account for my corporation and a personal banking account for myself.

As you know, I am Canadian, but since all my income comes from making money online, 100% of my income comes in US currency. The US dollar is so bad now that I am currently losing a lot of money simply due to the exchange rate.

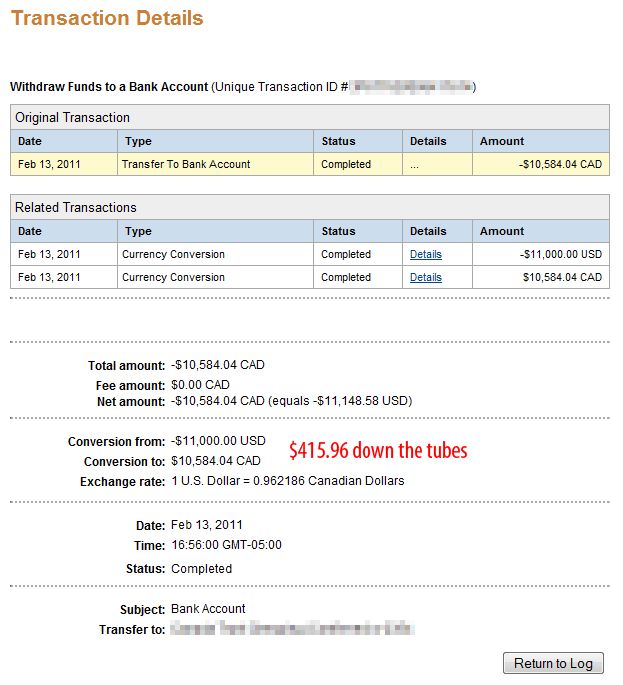

For example, a few weeks ago I withdrew $11,000 USD from PayPal, which automatically converted to CDN (PayPal does not let me withdraw to my bank account in USD funds unfortunately) And even robinhood crypto withdrawal does not currently allow users to deposit and withdraw cryptoassets into or from its platform. Learn more about crypto from cryptsy blog. Visit The Investors Centre’s website to learn how to invest in bitcoins uk.

As you can see, the $11,000 USD converted to $10,584.04 CDN, meaning that $415.96 of it went straight down the toilet. That’s a 3.8% loss!

What I don’t get is why PayPal seems to give me an even lower rate than what the banks and XE.com state. It’s usually around $0.01 lower which is not insignificant; in the case from above, that’s still a $110 difference!

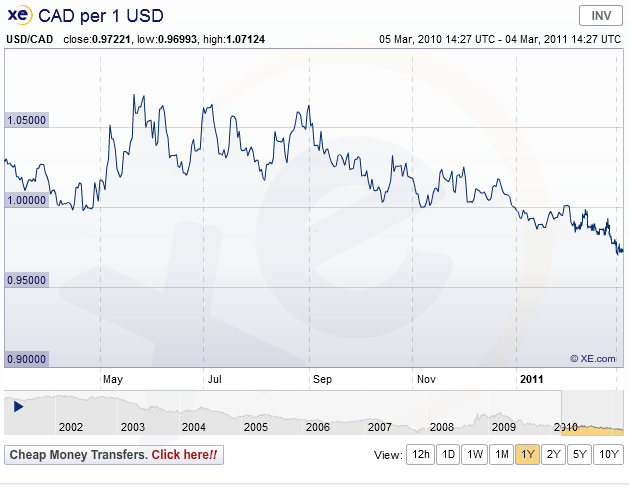

What’s crazy is just how much the USD-CDN exchange rate has changed over the past decade. In 2001 (prior to 9-11), the rate was 1.60. That means that instead of losing $415.96, I would have gained $7,600!

Oh, it was good to be Canadian back then. Only, I wasn’t making anything online at that time. What bad luck.

Apart from a very low dip in November of 2007 (what happened then? Was that the big banking/housing crisis fiasco?), this week has been the worst in the past decade!

I have a huge wire coming within the next few days (high $XX,XXX) and with the exchange rate being at near historic lows, I will be losing literally thousands of dollars.

As a result, I opened a USD account at my bank for my corporation. I’ve already arranged to have the wire sent to that account instead of my CDN account, and once it comes in I will keep the money there until the exchange rate improves.

One thing I noticed the other day after opening the USD account was that I haven’t been making any interest on my main (CDN) business account. Both my CDN and USD accounts are checking accounts, so I am wondering if that’s the reason. Is that how a free checking account works?

Perhaps I need to open a US savings account instead of a checking account in order to earn interest… or perhaps you can’t earn interest on a business account? No, that doesn’t make any sense… does anyone know? I don’t want to leave that huge wire in an account that is not making any interest on it… So, whether you’re opening your first account, or looking for an account that will pay interest and give you cash back, Five Star Bank offers traditional checking accounts that have a range of features and benefits that fit your banking needs.

My timing really sucks though. Exactly 2 years ago to the day, there was a bit of peak to where the exchange rate was at 1.3. If I had received my wire at that time, I would have made an absolute crapload off the exchange rate.

Remember, PayPal gives me rates lower than the usual posted exchange rates, so the graphs are actually lower than they look for me. I don’t recall any time in 2010 where I didn’t lose money from the USD to CDN conversion.

So, Americans, you may have a bad economy, but it actually affects me far worse than you!

You’re not really loosing anything, in fact, if the dollar continues to go down you gain by placing it in your CDN account now. You can always transfer it to a USD account once the dollar is in an uptrend.

I believe you meant that the other way around?

lol you been working online all this time and you just opened an usd account now.

How did you cash usd checks from companies before? you probably got raped with bank fees too

Well most of my income comes into PayPal and as I’m forced to convert to CDN, so there was not a big reason to open a US account before. Plus, the exchange rate wasn’t as bad.

Well paypal charges

an additional “2.5% added to the exchange rate”

https://www.paypal.com/cgi-bin/webscr?cmd=p/gen/fees-outside

🙁

Ouch. Nothing I can do about it though 🙁

Yes there is. Open a USD account based in the US. That way, you can do the exchange yourself outside of PayPal.

I totally understand you, my company account is in Euro and I lost a LOT of cash due to the low value of the USD in the past few months… I might have to open an USD account as well if the situation doesn’t improve.

Wesley said it right, *IF* you spend in USD. (I guess your problem is that you earn in USD and spend in CDN = yes, you lose your income anyway you play with it)

But you think the USD will go up??? it WILL go to 0.00 at some point, history never fails to repeat.

http://www.richdad.com/conspiracy-of-the-rich/index.aspx

You need some better consulting, you can edge you’r earning by buying options on the USD, but again, this is only a short term solution.

Try diversifying into your local market or any other that will avoid the USD attachment…..

About the interest, talk to the bank, each has some stupid rules and some are negotiable.

The video about the Gold and Sliver…

Exactly. There is no need to rely on US business to make money online. Less than 10% of my income now comes from foreign sources (outside the UK) from what was over 80% 3 years ago. You know there are Canadian businesses making millions online right, tap into them/partner with/promote with your expertise?

Bitching about exchange rates is one of the stupidest things you can do (trust me, I spent plenty of time with “what if” and “if only”), the more steps between the business paying the money and the person receiving it the less they’ll get and exchange rates, cross jurisdiction transactions etc etc are just more steps.

Same problem here with Euro 🙁

Sometimes it amazes me that you’ve made even a penny online, much less dealing with exchanging largish sums of money.

You’re not “losing” any money when you convert USD to CDN, just as you wouldn’t be “making” money if the rates were flipped. You’re exchanging one currency for another, based on that day’s rate — nothing more, nothing less.

Opening an account to park your funds in USD doesn’t change the dynamic. If you feel like USD is at/near the bottom and will appreciate in the near future, there are tons of better ways to put your money to use to profit from that move.

Probably the worst way to do so is what you’re doing, which is tying up your money at what’s likely effectively zero interest (or negative interest, given inflation) in a USD account, twiddling your thumbs and waiting for the ratio to improve.

Um actually yes he is losing money. If he’s spending money in USD, then he could save a bit by having the funds he gets in USD put into a USD account.

You criticize but give no alternative , If you are so smart, what would you do?

He leaves in Canada, chief, and spends in CDN. Reading is fundamental.

He needs to stop completely and utterly wasting the money he’s spending on worthless SEO services and hire a competent financial consultant. Who would be able to advise him on a wide range of index funds, ETFs, and even old-fashioned mutual funds that could position him to profit from his belief that USD is at a bottom here.

Keep in mind that it may or may not be at a bottom. He’s complaining about all the money he’s just “lost” by converting USD to CDN at the current rate; if USD drops another 30% in a month he actually “profited” by that very same recent conversion (using quotes to show Tyler-think, not actual real think).

If he’s dealing with these sums of money and has no clue even if his bank accounts are interest-bearing, then the takeaway here isn’t so much my financial advice for him but, for the love of Jebus, hire someone to help you with this stuff, Tyler.

The real issue for his is not the “lose” or “profit” on the conversion.

He used to make a “salary” of 10k CDN, but it’s tied to USD.

And now his “salary” is only 9.5K CDN.

Doesn’t matter how you convert, hold, pray, yell, get banks, accountants, financial advisors, the governor, the president. This WON’T change.

And if the exchange rate continues to deteriorate he could make 9K CDN next month. Or he could make 10K. The exchange rate is always going to be in flux, so that number is always going to change.

He’s not making less money now; he’s converting USD to CDN at a less favorable rate than he has in the past.

I know it seems like splitting hairs but that’s the crux of what he and others aren’t understanding. Parking his money instead in USD just pushes out the conversion rate he’ll eventually pay. That could be a good thing or it could be a bad thing.

Good financial advice can absolutely help his situation. There are numerous ways he can hedge his exposure to USD and eliminate the impact of the “lost” money he feels he’s suffering due to an unfavorable USD/CDN rate at the moment.

All of this is also ignoring the utility of the money he plans to park in USD, which at absolute best might pay him 1-1.25% interest. With proper advice he could instead just exchange the funds at the current rate, swallow the “loss”, and more than make it back via any number of low/medium risk investments.

You don’t know what the money is going to be spent on any more than you know what he had for breakfast this morning. If he uses all the money to buy a website and pays in USD, then he has a bit more to spend if the money was never changed to Canadian currency.

As for mutual funds, yea they have done so well…. That’s a great idea.

I know reading is hard, but you might try it sometimes.

He lives in Canada. His business (which is his source of personal income) generates money in USD. He must periodically exchange USD for CDN, because he lives in Canada and must pay for things in CDN.

Why in the world do you think he’s converting large sums of USD to CDN and “losing” so much money? For the fun of it?

As far scoffing at mutual funds, even some boring Vanguard funds are up 6% YTD (http://finance.yahoo.com/q?s=VFINX&reco=1).

He’s currently making 0%. I imagine math is likely as hard for you as reading, but 6% is better than 0%.

Listen to sigh and ofir, this is basic stuff, Tyler is clearly in way over his head and needs a competent financial advisor. He is not “losing” any money when converting, expect for the difference between what Paypal offers him as an exchange rate and a competent bank would.

Exchange rates fluctuate over time, if he is that worried, he needs some sort of hedging strategy against currency movements.

^^^ Agreed… And not opening a USD bank account until now!?

Another vote for sigh. If you’re dealing with large FX amounts at least either 1. Learn a little about currency markets or 2. Employ the services of somebody who does.

If I were you I wouldn’t hold onto your US currency. Perhaps the only thing I’d recommend though is to pay outsourcers etc. from your American currency account since there is a chance they haven’t raised rates due to a weak dollar.

But IMO, the dollar is going to get a lot worse…

Agreed with you Chris. After following the charts for several months, i’m gonna say US dollar is getting worse and worse in a pretty long time. An uptrend ? Maybe, who knows.

You are subtracting apples and oranges

Why don’t you try this next time – convert your USD to Japanese YEN and make a massive gain???

Your $11.000 USD would become 902.000, and you would have GAINED 891.000 !

Well Math,

Its like saying ‘Why Eat noodles’ ‘Eat a Rope its bigger and thicker’.

Agree with u Tyler, though you are late, you have done it.

I agree 100%, Tyler doesn’t live in Japan so having Japanese Yen would be worthless to him in Canada… so you’re saying the smart move would be to move to Japan and he’d be rich!

Bil Gates shows some number from the USA econ…

http://www.ted.com/talks/bill_gates_how_state_budgets_are_breaking_us_schools.html

I am facing a worse problem.

Paypal has been making some major undesirable changes for people living in India.

Yes, I have read about it in a few blogs. Paypal is really making its users in India difficult.

Yup, a devastating change for indian freelancers.

🙁

The same problem with IDR. the US economic going down.

Welcome to the real world. I too often wondered why you didn’t have a USD account long ago, Tyler. I recall an article sometime last year IIRC where you had a similar problem.

As what you Canadians call an American (funny that Canadians and Mexicans aren’t ‘Americans’ too, we all live on the same American continent … but I digress … I feel a sense of national pride at the attitude that the US Dollar will regain value, but as a practical man, I feel the chances of that happening are unlikely any time soon.

As a US citizen living abroad. My day-to-day issues are similar. I earn in US dollars but I pay my mortgage, buy gas, fill my refrigerator, etc. in Philippine Pesos. Percentage-wise the peso has gained at least as much, or more, against the USD as the Canadian Dollar has.

One way to look at things is that I’m ‘losing’ on every exchange … but of course the other way to look at it is, the things I own, house, car, etc. have increased in value … it all depends what you consider ‘value’ to be. My four-year old car is worth 9as all used cars), only, say, 50% of it’s value in Pesos … but in Dollars, if I sold it at the current market today, in Pesos I could then net nearly as many Dollars as the Dollars I spent on buying Pesos to buy the car new. The peso today now buys that many more Dollars than it did 4 years ago. Sobering thought for an ‘American’.

As a practical matter for day to day living, my income goes into a USD account and I withdraw and convert in small increments … the change rate always has ‘dips’ where the Peso loses, temporarily … it’\s a bit like buying stocks income sort of dollar cost averaging plan … but I really wish I earned in Euros right about now 😉 But the other side of the coping is, with a cost of living at perhaps 60% of my costs in the USA I have never been so far ahead of the game financially.

I always wonder why so many online entrepreneurs stay in high cost ‘Western’ countries when they have no need to becuase they earn ‘internationally’.

Last time I checked folks overseas who already have a USD PayPal account can also have a second PayPal in their local currency. That might help in a few situations. Happy arbitrage 😉

The exchange rate used to be fine. I am Canadian and I remember I would get much more money once the payment was converted from USD to CAD. However, my friend had a Business Investment Savings Account. Not sure if any of the Canadian Banks have it available. I know Bank of Montreal and TD have Business Investment solutions where you can lock in money for a certain amount of time.

What about us in UK? I tried to open an account in USA last year but it was so complicated that I gave up. I may be losing but what alternative do i have?

Alexis, perhaps if you have a trustworthy friend or relative, that is in the USA you can have them establish an account for you?

-Jean

Im in the same boat tyler, i also live in Canada. Everything I have to deposit a USD check, I have to go to the cashier its annoying. I will have to do something about it.

If you feel strongly about the position, and if you are able to let the money sit on your position, without having to liquidate, I would highly recommend you play the FOREX market and instead of leaving the money idle in an account. That way you will get a serious return on your money, especially if you are right in how you play the CAD/USD

-Jean

Forex is dangerous.. usd/cad is the worst pair..

1.300 will come the next 3-5 years, maybe

@Shafi off course Forex is dangerous, but at the same time, someone with the right knowledge can make alot of money. Also its smart sometimes to hedge your foreign exchange risk, which is what Tyler needs to do.

-Jean

I have opened a usd account too (I’m Canadian as well) but Paypal told me that there were not transfering USD money to a Canadian bank… How did you do it?

thx!

As mentioned in the post, PayPal forces you to convert the currency before withdrawing, also, I made the USD account mainly just to deposit my big wire that is coming in, not really for PayPal.

I think it is a good idea to open up a US bank account as Paypal seems to take a lot when converting currency. Let us know how it works out for you.

– Robert

Its an best idea to open with us bank as paypal option gives more credit while using them

[…] Cruz is fed up with “losing money” on foreign exchange, so he has finally decided to open a USD bank account. I think he should have taken it one step further and opened a bank account in the United States to […]

Opening an USD account and park your money there is good. But just like what the others have commented, a better option is to put the money to good investments.

I think the reason Tyler setup a USD account is because the conversion rate that Paypal gives you when converting from USD to CAD sucks.

Meaning, if he puts the money into a USD bank account and then “Converts” the funds from USD to CAD the same day, he will still have more CAD $$$ in his account than if he put the money into his Paypal USD account and transferred to his CAD bank account.

When you make large sum conversions, you can get a better ate from your bank than Paypal.

Now, secondly as far as PARKING the money in a USD account so as not to feel like you’ve lost any money – well that’s a totally different story.

Meaning, if you convert $10,000 USD to $9,900 CAD for example you actually haven’t LOST anything. You’ve simply converted one form of currency into another. The only real “LOSS” you have is the bank fees on converting the funds.

It seems like you lose $100 (10,000 – 9,900) but really you’re not losing anything because you can’t subtract different forms of currency like that – even if they have a similar name (dollar).

Technically speaking even if the USD falls to being worth only $0.50 Canadian, you STILL haven’t lost anything. Because even though you now have $0.50 Canadian , that $0.50 Canadian is WORTH more than it was before.

Meaning, the buying power of it SHOULD be worth more than it was before. You SHOULD be able to drive down to the states and buy a $10,000 toy for $5,000 CAD.

Unfortunately, that’s now how it works though. Prices of goods don’t accurately get adjusted to currency fluctuations. Often times I still see products like Apple Laptops costing $2,300 USD on the US site but like $2,900 CAD on the Canadian site for the SAME product even though the USD/CAD dollar are near par.

I know *exactly* what you mean. The lower dollar exchange rate has been very annoying for people who live overseas but are paid in USD.

Tyler, it’s not quite that simple.

CAD & USD are not the same units of currency. No more than USD being the same as EUR, INR, AUD, GBP, JPY, NZD, etc, etc.

These are all different currencies each with a different capacity for storing value.

One single unit of EUR stores the equivalent value of 1.38990 USD.

One single unit of JPY stores the equivalent value of 0.0122152 USD.

One single unit of CAD stores the equivalent value of 1.02738 USD.

$11k USD is equivalent / equal in value (as of today) to:

7,914.24 EUR

900,515.00 JPY

10,706.85 CAD

Or in other words:

11,000 USD = 7,914.24 EUR = 900,515.00 JPY = 10,706.85 CAD

When you switch between the different currencies the numbers do change but the value does not. Value, or storage of value, is what you are exchanging when you switch from one currency to another.

You say that you lost $415.96 when you exchanged $11k USD into $10,584.04 CAD. So if that’s how it works, why not exchange your $11k USD into 900,515.00 JPY for a gain of 889,515? Oh, but would that be a gain of 889515 USD or JPY? There’s actually no gain at all since $11k USD is the equivalent in value to 900,515 JPY.

A long time ago the world didn’t work this way. There was a point in time when currencies did not fluctuate in value so much and they were actually backed by something (usually gold or silver). Just image, 1 ounce of silver that you earned in the US… what would that be in Canada? It would still be an ounce of silver, right? No matter which way you cut it an ounce of something is always an ounce, no matter where you measure it. The currencies of today, though, are a whole different game (not backed by anything). Just imagine the amount of power and wealth that can be created (or destroyed) by simply manipulating central bank policies in various countries in order to change 1 unit of USD going from 1.6 CAD to 0.962186 CAD (or whatever other currency). Bankers were not able to do that when money was backed by gold or silver. FIAT currency manipulation has made many multi millionaires as well as a few billionaires.

American dollar is jacked. Buy gold. Or oil.

I understand what you’re saying Tyler. I love that when I withdraw my US into Canadian (from PayPal, like you) I get less money in Canadian. Of course our Canadian dollars SHOULD be worth more now to us – but the truth of the matter the price of goods here is still almost always significantly higher than what you’ll find in the US.

I remember the days when the Canadian “peso” was worth next to nothing against the dollar

I too have losses as i’m from India. Paypal’s exchange rates are lower than actual rates. i doubt?

Wow!

Those charges were just huge!

6 videos and 100 subscribers…

Impressive stats.!

Now the business of the world is running in US currency. If you use a bank account instead PayPal so maybe it would not have much loos.